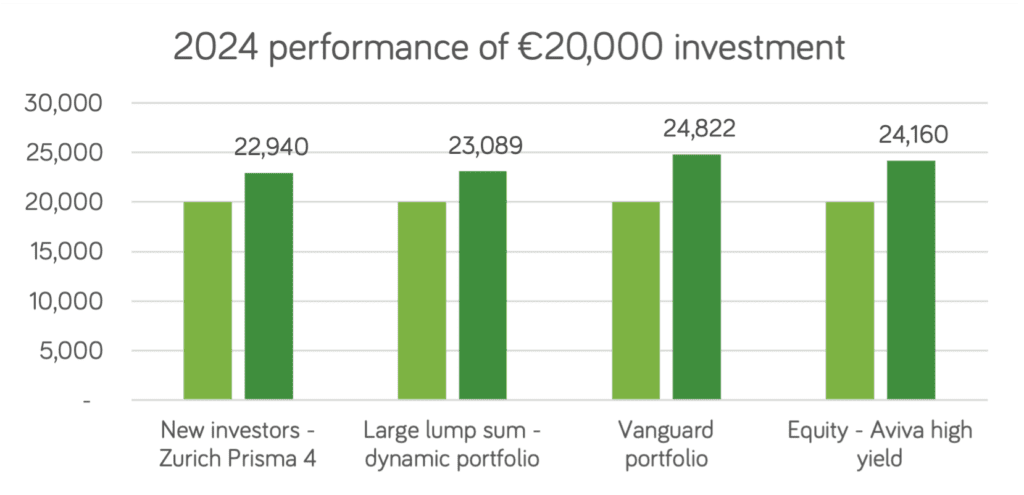

Each year, we pick a handful of investment funds available to Irish investors and highlight them on our blog. We’ve charted below how our 2024 selections performed.

Interested in our 2025 picks? Click here to read more.

2024 was a good year to have your money in the stock market. Equity markets were up 25.3% in Euro terms (measured by the MSCI All-Country World Index).

But that large rise hid much variance in performance in other assets like bonds and property. There were also great differences among individual funds. As we said at the start of the year:

Tech valuations looked high but could go further, and value stocks looked promising;

Bonds looked tricky as policymakers navigated interest rate cuts as inflation fell; and

Politics and conflict would continue to dominate markets through the year.

We’ve set out the one-year performance of the funds we recommended at the start of the year in the charts below.

We didn’t get them all right – our value equity choice for dynamic portfolios, Scottish American, was basically flat. Saints, as it’s known, was hit in particular by the poor performance of its large holding in Novo Nordisk, the Danish pioneer of weight loss drugs. At one time Europe’s largest company, Novo Nordisk reported disappointing trial results in 2024, and concerns grew that its leadership in obesity treatments could be under threat.

Of course, as this fund is only ever one of several in an investment portfolio at Moneycube, and there were winners too, including Scottish Mortgage, run by the same fund manager and up more than 23% in Euro terms in 2024.

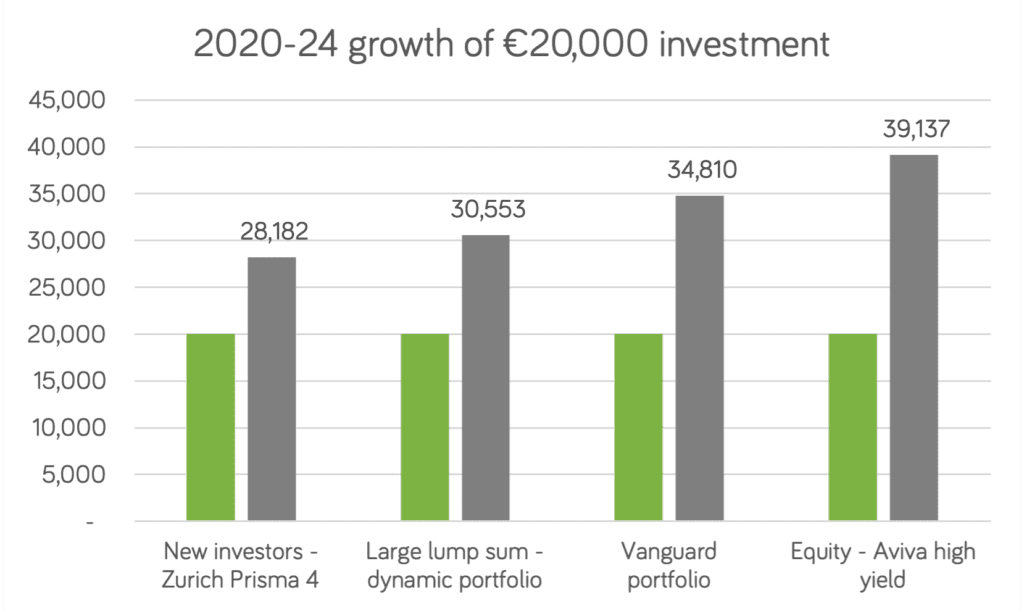

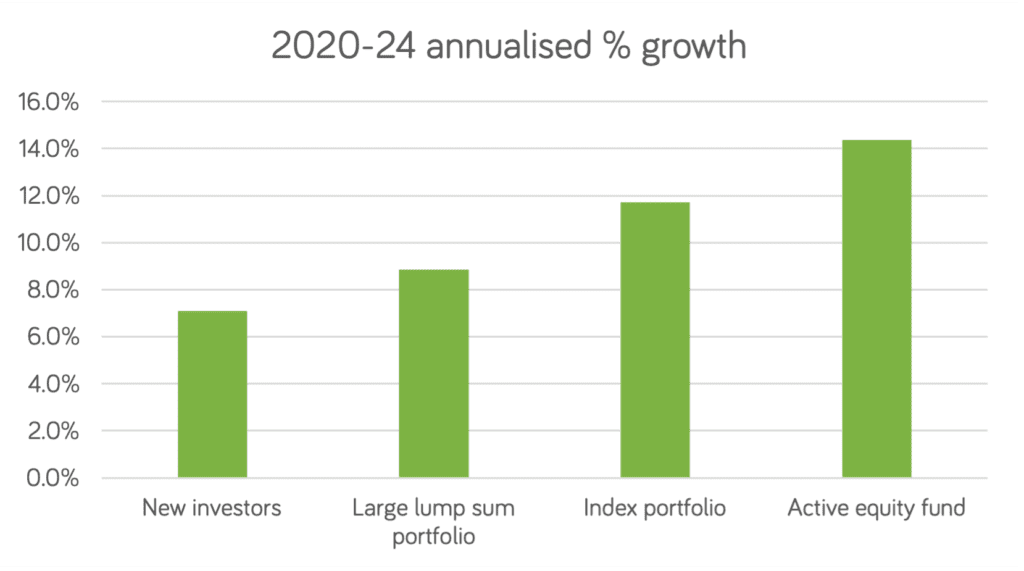

And secondly, it’s the longer term that really counts. We’ve charted the five-year performance of our 2024 chosen funds below.

As you can see, they have all turned in solid long-term growth. Even the lowest performer here is up more than 7% over five years. Compare that to five years of rock-bottom interest rates in the bank!

You must be logged in to post a comment.