Inflation in Ireland is hard to ignore right now – a trend we identified a year ago.

If you dig into the data, however, inflation is still confined to a small number of sectors. Others are experiencing little in the way of cost increases, and at times even deflation. Digging into the causes of inflation is also helpful to understand how this period of cost rises might come to an end. And that has implications for how you invest your money. What’s really driving inflation in Ireland?

The 5% barrier

Annual inflation in Ireland has been running at more than 5% for more than five months now. Cost increases hit 5.1% on an annual basis last October, and have barely reduced since.

At the same time, there’s little sign that the European Central Bank, which governs Irish lending rates, will increase rates any time soon. Only this week the ECB’s president commented that she saw little risk of ‘stagflation’, where cost rises and low growth combine. Instead, the intention is to keep rates low – meaning the value of money held in cash continues to be eroded.

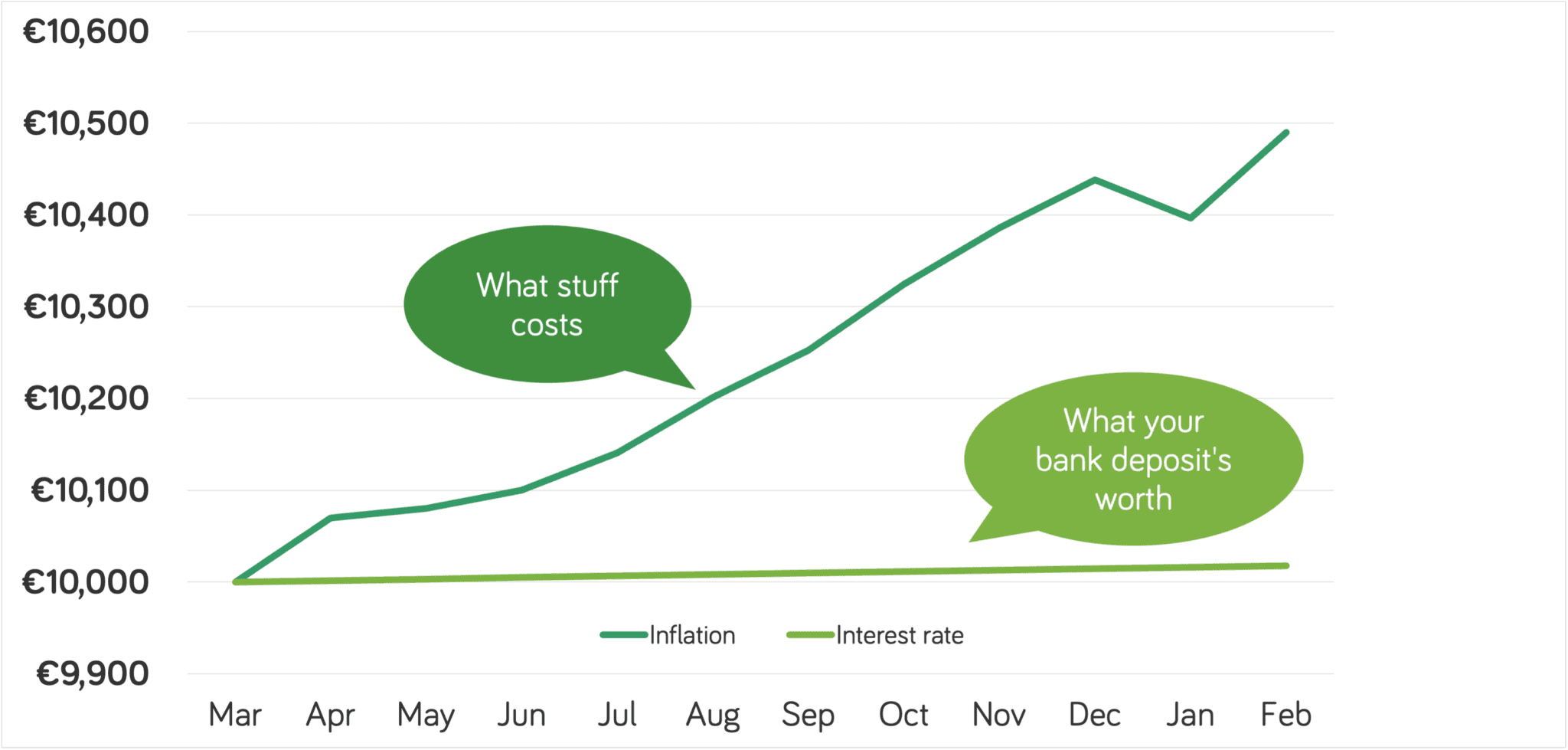

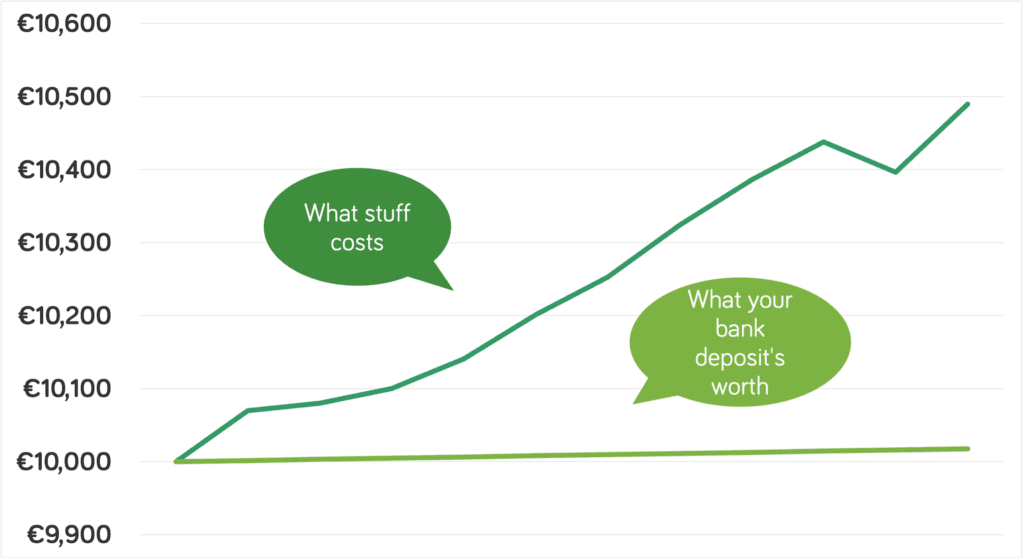

Here’s a chart showing the financial effect of inflation and near-zero bank interest on €10,000 held in cash over the last year.

Source: Central Statistics Office, Consumer Price Index, Feb 22

Energy costs are a major cause

There are two big drivers of inflation in Ireland just now: energy, and food. While rises in one will ease off, cost increases in the other will be with us for some time.

The cost of energy – in particular oil and gas – is closely linked to the war in Ukraine, and attempts by the western world to wean itself off Russian gas.

Energy costs in turn have a huge effect on many other aspects of the economy. For example, they impact heavily on transport costs – up 15.4% over the last year, which in turn drives the cost of many goods we buy. Other areas heavily impacted are household energy costs (up a whopping 28.7%), as well as industrial production.

But energy cost rises are being addressed by governments worldwide. From re-assessing nuclear, to increasing US oil production and efforts to reintroduce Iran and Venezuela into the global oil supply system and coaxing more production from major suppliers, alternatives to Russian oil are being brought online at pace.

Alternatives to Russian gas are harder to introduce, because gas is more difficult to transport. But they are being developed. This week a plan to bring an extra 15 billion cubic metres of gas to Europe from the US was agreed, along with joint initiatives to develop clean and renewable power alternatives.

The supply picture for oil and gas is going to look quite different in six months, helping to reduce inflation.

Food is harder to fix

The second big area of inflation is food, up 2.9% over the last twelve months, according to the CSO. This is a tougher challenge.

Together, Ukraine and Russia accounted for 22% of global grain exports, for example. While peace cannot come quickly enough to Ukraine, rebuilding its food export levels will take time, whether its recovering from disrupted planting and harvesting, to fixing road, rail and port infrastructure damage.

At the same time, Russian exports are being frozen out to a great extent, further limiting supply.

It seems that food inflation will be with us for some time to come, and the rate of inflation will likely increase.

The CSO did report one bright spot: the price of potatoes reduced 4.2% in the year to February 2022!

In fact, there are several areas where prices are falling, from motor insurance (down 10.7%) to education (down 0.8%), and jewellery and watches (down 15%).

The impact for investors

When inflation is high, investors have three big issues to consider.

1. The cost of holding cash

It’s been clear for many years that holding cash in the bank in Ireland is extremely unrewarding. But the decision not to invest takes on a new dimension in a high-inflation environment. Not only are you missing out on growth potential: the value of your cash is actually reducing month-by-month.

2. The effect of rising interest rates

While rates in the Eurozone show little sign of rising, in the US and UK, rate rises have already been implemented, and more are likely to follow.

Rate rises affect the price of bonds (long-dated bonds typically fall in value as rates rise) – and by extension the bond holdings of multi-asset fund investors. They also have an outsize impact on companies which are unprofitable today, but promise large future returns, because the present-day value of those returns is discounted more heavily.

3. The impact on investment choice

Some investments perform better than others in an inflationary environment.

It pays, for example, to have exposure to companies with strong brands, which can push up prices without seeing a major fall-off in demand. And investments that can continue to pay a steady income in a rising cost environment – for example some infrastructure funds – become quite attractive to many investors.

Moneycube can help you navigate these challenges as you put your money to work. Read more about how inflation affects investors here, or get in touch today.

You must be logged in to post a comment.