At Moneycube we believe more people should think about investing their savings.

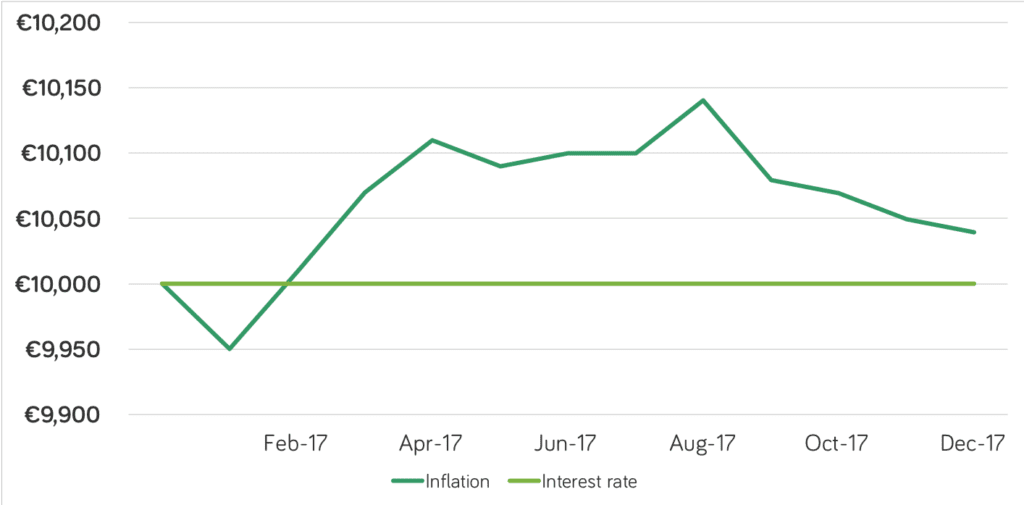

One big reason for that is because it is almost impossible to grow your money by leaving it on deposit in the bank. Deposit rates continue at near-zero levels.

And so did inflation in the last month of 2017, according to the Consumer Price Index.

Prices actually fell 0.1% during December 2017, with clothing and shoes dropping nearly 2% as winter sales kicked in early.

But overall, prices rose by 0.4% during 2017, the Central Statistics Office says.

This followed two years of calm for consumers, with prices staying flat in 2016, and actually decreasing a little in 2015.

It’ll be no surprise to anyone paying rent that it was among the biggest risers last year. Rent was recorded as going up 6%. Restaurant and hotel prices, as well as transport costs, rose by more than 2%.

Many commentators are suggesting 2018 will be the year when inflation really takes off, in particular as wages start to rise. The OECD think-tank reckons it’ll be north of 2% by 2019.

It’s one more reason to consider moving your money out of a zero-interest bank account.

The Moneycube inflation eater shows the impact inflation is having on your savings. It’s updated each month, once the Consumer Price Index is published by the CSO.

Tired of watching inflation eat into your savings? Get started with Moneycube today