At Moneycube we believe more people should think about investing their savings.

One big reason for that is that it is almost impossible now to make any money by leaving it on deposit in the bank. Deposit rates in Ireland continue at near-zero levels.

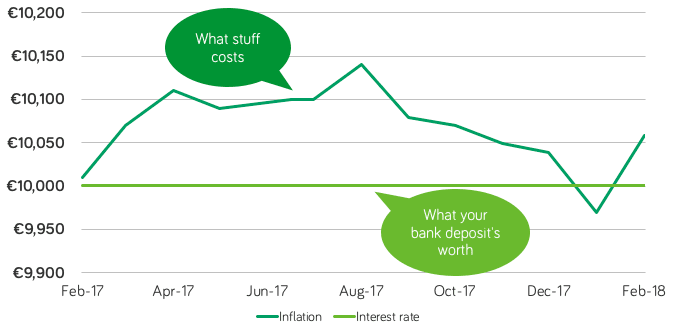

Inflation’s off again

But inflation has been climbing again, as data from the Central Statistics Office shows.

After easing off in the second half of 2017, carried through into the January sales, prices were hiked in February as you can see on the chart.

0.5% up on 2017

Compared with the same time last year, prices are half a per cent higher.

The main culprits are housing and energy, as well as rising restaurant and hotel costs.

The CSO puts rental price rises at 6.2% over the last year. If anecdotal evidence is anything to go by, this sounds a little on the low side. For comparison, the CSO reports annual Irish house price inflation at 12.5%

There are a couple of rays of light for the hard-pressed consumer. Home furnishings and maintenance are reported down 3.5% in a year, and clothing down 2.8%.

Deposit rates are still on the floor

With inflation rising, now might be the time to reconsider putting cash on deposit to better use.

According to bonkers.ie, the best interest rate you’ll get for a €10,000 lump sum no-notice deposit is just 0.3% (from KBC Bank). After you’ve paid DIRT to the government on that, you’ll be sitting on a princely €10,018.90 after a year!

Why not talk to us today about how you could put your money to work in investment funds?