Sometimes the challenge with investing is not identifying great opportunities – but getting access to them. Many of the best growth stories in recent years have come from companies that have stayed away from the public markets, and grown with private capital.

Stripe and Revolut are just two examples of multi-billion businesses that have grown without offering their shares to private investors (yet).

So how can investors in Ireland get exposure to these growth opportunities? Read our rundown on investing in private equity, and some ways to get involved.

What’s private equity?

First, the basics. Private equity houses are in the business of investing money on behalf of their customers in the shares of unlisted companies.

Private equity houses have a reputation for aggressively managing their investments (so-called asset stripping). In reality, many private equity funds provide capital and expertise to back ambitious management teams at a time when raising funds publicly would be less desirable.

Why invest in private equity funds?

Investors are attracted to private equity for three reasons.

Firstly, typically, private equity investors get involved in businesses at an earlier stage of the business’s life.

They add capital to fund rapid expansion. Arguably, there is a better chance of high growth at this stage. It’s just not that easy to double the size of, say, a €100 billion business.

Secondly, the growth opportunity.

By definition, private equity funds are looking for high returns on their capital. An annual return expectation of over 30%, doubling the money invested over three years, is not unusual.

Of course, the flipside of getting in early, and looking for high growth opportunities, is risk. A significant amount of private equity investments fail to deliver their target returns. The successes need to pay for the failures – and deliver strong returns to the underlying investors.

So while they can offer strong returns, investing in private equity isn’t for the faint-hearted.

Lastly, private equity is attractive because it offers access to off-market opportunities.

Thirty years ago, the standard passage of a business was often to start using private capital, and raise initial money from a venture capitalist. Then, once the business achieved some momentum, to list its shares, perhaps on a junior market before ‘graduating’ to a listing on a major stock exchange.

Nowadays, more businesses choose to remain unlisted for longer, so investors are at risk of missing out on fast-growth opportunities.

Revolut, for example, has remained private while raising funds this month at a valuation of $33 billion. Investing in private equity is one of the main ways you can work these opportunities into your portfolio.

How do I invest in private equity?

There are two main ways to access these investments.

Some private equity funds are themselves listed.

For example, 3i has been available to regular investors for more than a quarter of a century.

Arguably the original European private equity house, 3i was founded by the Bank of England in 1945, with the aim of investing in small and medium UK businesses. These days, it has offices across Europe, and in the US and Asia, and it’s valued at nearly €15 billion.

Another private equity fund available for direct investment is Hg Capital.

Hg Capital bills itself as ‘Europe’s largest investor in software & services’, with over 170 underlying investments. They also claim impressive recent results, including that their ‘combined portfolio represents 2nd largest tech firm in Europe, with the fastest growth’. In numbers, that’s 20% growth in sales in the year to March 2021, and 30% growth in Ebitda (a profit measure).

Invest via a fund

The second route to access private equity is to use a fund which itself invests in a range of private equity funds.

Moneycube prefers a fund-based approach as it gives access to a wide range of investment opportunities, management styles and geographies.

One of our favourites is Standard Life Private Equity Trust. This fund spreads your money among 17 private equity managers, and also co-invests directly alongside the private equity managers it backs.

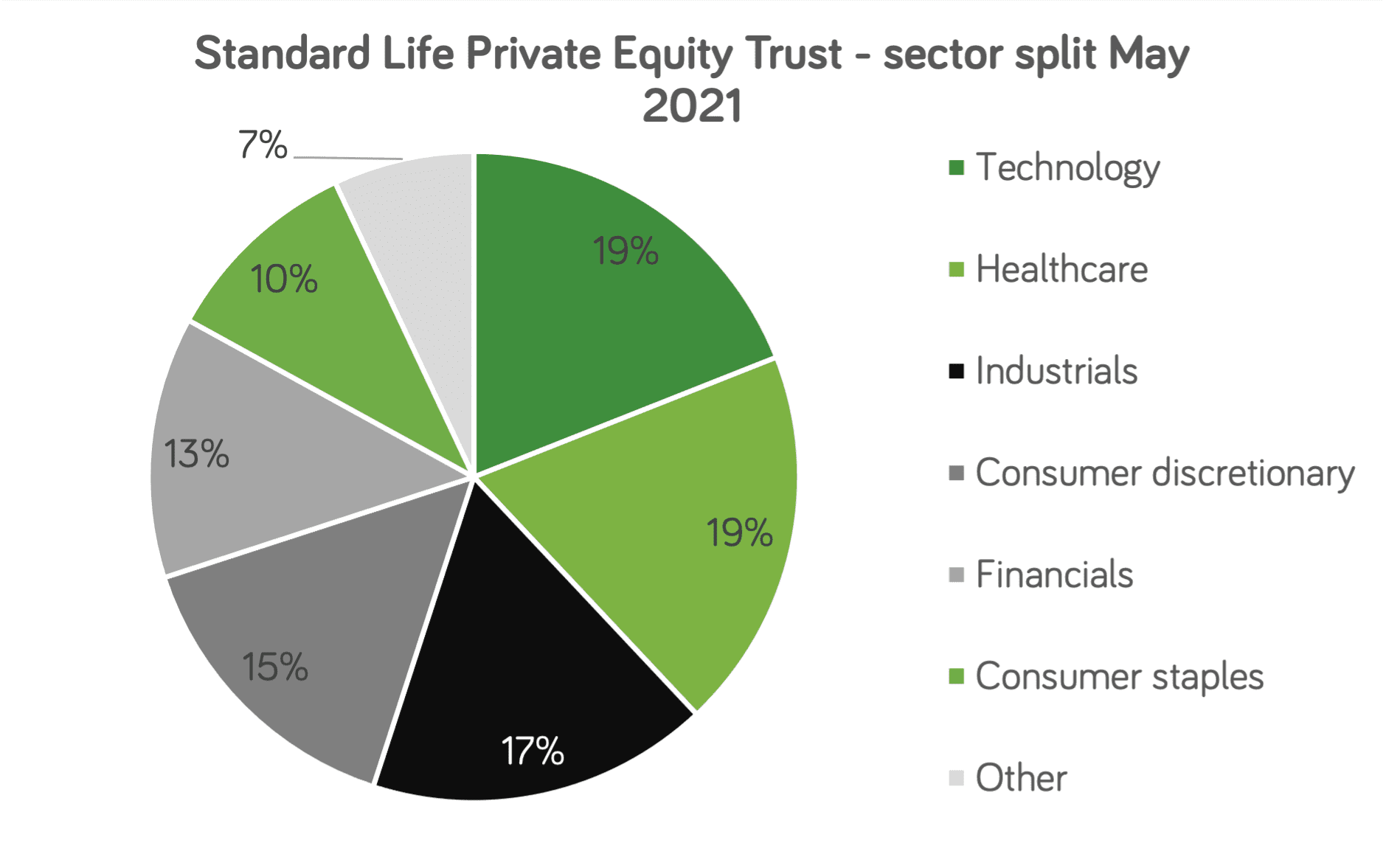

The fund gives investors exposure to more than 450 underlying companies, spread among a wide variety of industries, including nearly 40% in hot sectors technology and healthcare.

Access to the best-known names

It invests in funds from some of the best-known names in private equity, such as Permira, Advent International, and Six Nations rugby investors CVC – not to mention Hg Capital and 3i.

SLPET has delivered a cracking recent performance, rising 58.5% in GBP terms in the year to May 2021. Over longer periods, its record is also strong – up on average 18.6% over five years, and 13.9% over ten.

From public markets to private equity and back again

One view of private equity is that it enables businesses to get themselves shipshape before raising finance from investors in the public markets.

In a pleasing symmetry, two of the biggest contributors to SLPET’s success in 2021 were the flotations of bootmaker Dr Martens and online greeting card business Moonpig on London Stock Exchange.

Moneycube can help you access these opportunities and many more – get in touch if you’d like to discuss your portfolio.

You must be logged in to post a comment.