What a month that was for investors. In the space of 30 days:

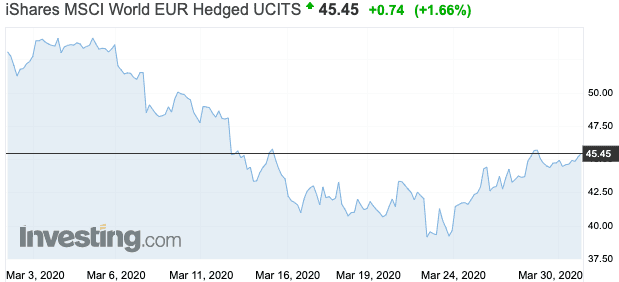

- World shares fell by 16.7% in Euro terms

- The S&P 500 recorded the 7 largest ever one-day points gains (yes, gains)

- Oil dropped to its lowest price since 2002

- The market’s ‘fear index’, the VIX, hit its highest level ever on 16 March, before reducing again

- Tuesday 24 to Thursday 26 March saw the biggest three-day rise in the S&P 500 list of top US companies since the 1930s

It’s a lot to take in.

As we’ve written elsewhere, the Coronavirus outbreak is above all a health emergency, and a human tragedy. But it also brings important considerations for your financial future.

So is now the right time to invest and to put money into the markets?

The case for investing

There are several reasons investors see now as a time to be fearless.

Firstly, a lot of bad news is already out there, and baked into the price of investments. The markets now expect major job losses, and a recession, in 2020 across the developed world – and prices have been adjusted accordingly.

Secondly, governments have intervened in a big way to prop up businesses and households. The aim is to minimise bankruptcies so that when the virus ends, they are able to get back up to speed as soon as possible.

Thirdly, the fall in asset prices was steep and speedy, and all kinds of investments were sold: company shares, government bonds, currencies – even gold. While company earnings will fall in the short term, based on long-term earnings, the overall price of equities is low compared to the last couple of decades.

That’s prompted commentators from major banks like JP Morgan and Morgan Stanley to suggest it’s now worth selectively increasing exposure to risk-based investments.

On the other hand…

…risks still remain.

Above all, it is unclear how developed economies will get back to work, with UK medical advisors suggesting it will take six months or more to resume some sort of normality.

Then there’s the mountain of debt governments have taken on to fund the lockdowns, and the impact of economic slowdown in the coming months.

But it’s worth remembering that investing always involves taking on risk. Financial markets will anticipate the recovery before it’s seen in the economic data – typically by three months or more.

Moneycube’s view

It’s impossible to call the bottom of the market: we’ll only know that in hindsight.

And anyone investing now needs to be prepared to stomach substantial ups and downs in their investment over the coming days and weeks.

But that doesn’t mean doing nothing.

Moneycube recommends a three pronged approach if you’re interested to take advantage of the dip in the market:

1. Get ready to invest now

In a lock-down world, that’s more difficult than usual. It might mean taking advice, identifying investment funds, and moving cash into an investment account, ready to be deployed. We can help with that.

2. Invest your money in chunks

The market is highly volatile, and likely to remain so for the immediate future.

Don’t bet everything on a single day in the markets: invest your money in several tranches over a period of weeks or months.

3. Diversify

It’s tempting to try and identify winners and losers from the current shake-up. But companies that have experienced a worse downgrade than others will have done so for a reason. What’s more, the financial information available publicly can be unreliable right now, with companies adjusting earnings expectations on real-time basis.

So if you’re placing some bets on shares that you expect to bounce back in a big way, consider balancing that with some investment funds for global diversification, and perhaps some gold for wealth preservation.

So while we’ll never know the best time to invest your money, on a pure valuations basis, investing suddenly looks quite attractive compared to recent years.

If you navigate it well, today’s volatile investment world can can be harnessed to your advantage.