At Moneycube we believe more people should think about investing their savings.

One big reason for that is that it is almost impossible now to make any money by leaving it on deposit in the bank.

And with inflation on the rise again, that means your bank accounts are worth a little less each month.

So we’re introducing the Moneycube inflation eater to show the impact inflation is making on your savings. We’ll be updating it each month, once the Consumer Price Index is published by the Central Statistics Office.

What does the chart show?

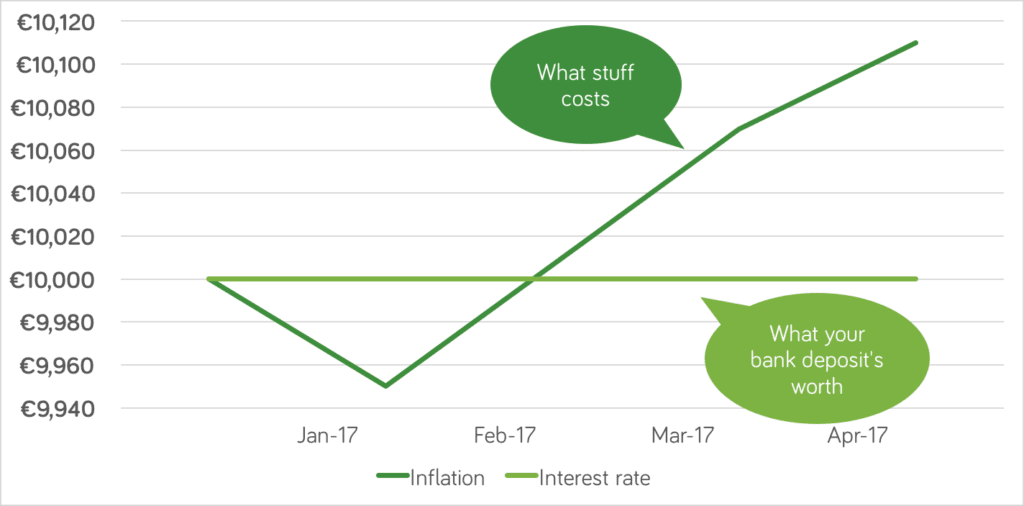

The chart focuses on the annual impact inflation has on your savings. We’ve based our analysis on a pot of €10,000.

Since the start of the year, it’s likely your bank deposits have gone precisely nowhere – so that €10,000 is still worth €10,000.

But inflation has been munching away steadily at your savings. Our chart shows the effect of inflation means you’d now need €10,110 to buy what €10,000 would have bought four months ago.

What’s happening my savings?

Well, the Central Statistics Office says that the costs of transport, especially air fares and diesel, are hitting our wallets. Private health insurance is on the rise, and so is the cost of eating out and staying in a hotel. On the bright side non-alcoholic drinks have got cheaper!

At the same time the bank interest rate has gone nowhere. It’s been at 0% for more than a year now, and even before then it was at 0.05% from September 2014.

That’s good news for folks on tracker mortgages… but not for anyone who is trying to build their savings.

Where do we go from here?

The Consumer Prices Index matters because when it goes up, our living costs go up too. Our savings are effectively worth less than they used to be.

The indications are that inflation will continue to climb, with the OECD predicting inflation of nearly 2% in 2018.

At the same time, there seems to be no let-up in the rock-bottom interest rates we’ve had for nearly a decade now.

It’s a good opportunity to consider other options where our money has some prospect of growing. Here at Moneycube HQ we think the answer for many people is to consider putting some of your savings to work in diversified investment funds. You can use our handy tool to visualise what your savings could look like, set a savings goal, and easily start investing.

Sources