State Street Global Advisors (SSGA) is one of the world’s biggest index fund managers, managing over €4.7 trillion across 30 countries. In Ireland, SSGA’s funds can be found on New Ireland’s pension and investment platform through the Prime range of funds, and direct to investors as part of larger investment portfolios.

To understand index investing in Ireland better, Moneycube talked with Barry O’Leary, Vice President at SSGA, about index investing in equities and bonds.

The conversation covers how index investing works in practice, how it differs from active fund management, the indices used in the Prime range, and volatility and future changes in index investing.

This is an edited transcript of the conversation, recorded in late February 2025.

Barry, tell us about your role and how it fits with SSGA globally.

I’m responsible for bringing our investment capabilities to New Ireland clients. The firm is very much a global firm. While we have some people based in Ireland, we leverage our global investment platform across Europe, in the US and in Asia we have people involved in managing these funds.

Stepping back a little bit further, SSGA is a one of the largest financial services firms in the world. The size and the scale bring a huge amount of regulatory scrutiny, and that obviously benefits clients. It also allows us to manage money efficiently and in a cost-effective manner.

So size and scale might sound boring but there are some tangible benefits for end-investors. That’s particularly the case with index funds.

We’re here to talk about the Prime funds range, which sits on the New Ireland life assurance platform. Tell us about the range.

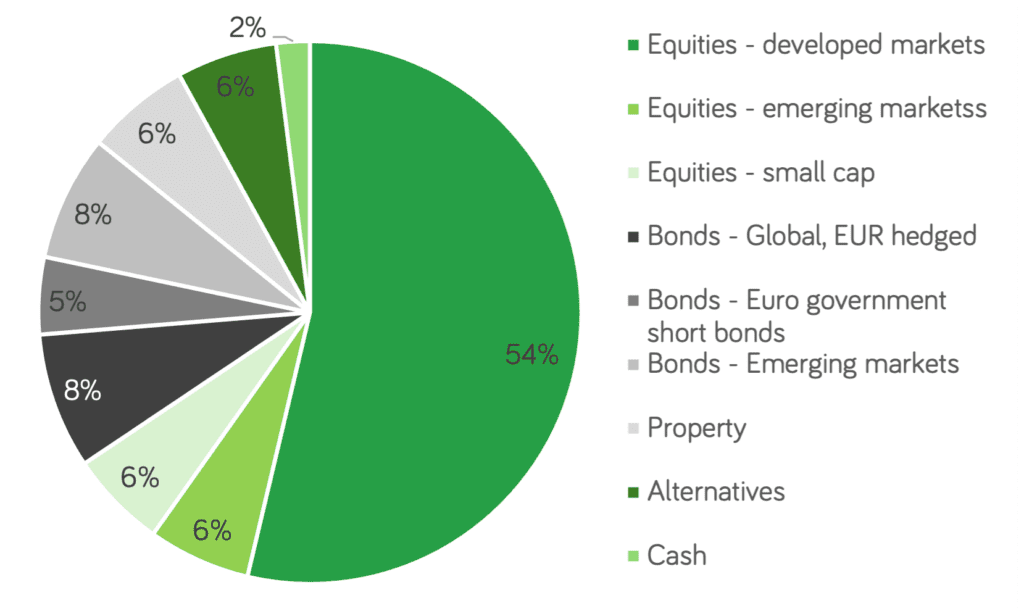

There are four Prime funds. They vary from low to medium to high risk. The lower risk fund is Prime 3. That would have maybe a quarter of the assets in equities (generally seen as the most aggressive asset class). It has some other growth-orientated assets like property and alternatives, and it has some assets you would typically call defensive. Around half of the portfolio is in cash and bonds, so you have a mix of defensive and growth-orientated assets.

As you move up the risk spectrum, to Prime 4, Prime 5 and Prime Equities you gradually increase the risk, and you increase the return potential as well. As you go up, you have more in equities and less in cash and bonds. The most aggressive fund is invested in equities at all times and that will give you also the strongest and best potential return over the long term.

All four funds use the same building blocks. The lower risk funds hold more of the less risky assets and the higher ones hold more of the riskier assets.

SSGA New Ireland Prime 4 asset split, Feb 25

Source: New Ireland

They’re managed by our specialist index equity or index bond teams. Again that’s a benefit of being with a firm of State Street Global Advisors’ size. Our investment managers are very specialized in their area.

We have a team dedicated to managing index equity funds, one to managing index bond funds, one managing cash and a dedicated team who brings all of that together and makes sure that the portfolio has the right blend of assets, is sufficiently diversified, has a good risk management process in place, and essentially you’re getting most bang for your book in terms of the trade-off between risk and return.

Let’s back up a bit. What is an index fund? And how do State Street Global Advisors implement it in practice?

There are two broad approaches to asset management: there’s index management or what’s often called passive investing, and there’s active management. If you think of world equity markets, if, for example Microsoft makes up 4% of the world stock market, an index fund invests 4% in Microsoft; if BMW makes up, say, 1% of a chosen index, then the index fund will invest 1% of its money in BMW.

Active managers in contrast make decisions on which companies are better investments than others. So they might be overweight or underweight Microsoft people.

The harsh reality is that many active managers don’t manage to beat the index. Index funds tend to be some of the best-performing funds. They are always towards the top of the league table, especially the longer you look out. If you look over five and 10 years, they tend to be better performing than a vast array of active managers. And because you’re not hiring a whole team of research analysts and portfolio managers there are cost efficiencies.

We do very complex and rigorous systems to make sure that we’re tracking the index and there’s a lot of research that goes into making sure that we’re doing it in the most cost-effective way, avoiding transition costs and reducing dealing costs. But by-and-large that’s systematic.

‘Passive’ is an awful name for it in some ways: a huge amount of brain power goes into making sure that you do faithfully track an index.

For example, when Saudi Aramco floated it was the world’s biggest company by some measures. That was a very challenging period for people who were running a passive Emerging Markets index because on one day it didn’t exist on markets and the next day it was the biggest company floated on the stock exchange.

It’s certainly not the case that this has been given over to a bot that can replicate that index performance.

Yes, for example, in equity markets we have to anticipate which companies are going to be added into the index and which companies will fall out of the index. We need to beat the market to that. If you’re selling a company that’s falling out of the index and therefore shouldn’t be in your fund anymore and you do it on that particular day, there’ll be huge trading costs and you might not be able to liquidate the position.

So there is some anticipation involved in that.

In the fixed income markets – which are much bigger than the equity markets –there are many more holdings, and there is work to make sure we are giving the index return but not trading as much as the entire index. So a lot of thought and a lot of scale is required to do the sufficiently to generate good returns and to minimize the costs for end-investors.

At Moneycube, we tell customers there are two things to think about when it comes to index investing. Firstly, what index are you following? Secondly, is your manager faithfully following that index?

So coming back to the Prime funds – tell us about the equity indices they follow.

There are three different equity indices. The largest is the MSCI developed world index. It tracks the developed market; the US, Canada, most of Europe and Japan. There’s are 23 countries in that index; all well-developed economies. That makes up around 80% of Prime Equities, because that’s generally the proportion of the global stock market that that it represents.

The emerging market index gives exposure to Brazil, Mexico, China and a lot of the Asian economies. That makes up around 10% of the equity exposure.

It’s a little more risky than developed market equities, but concurrent with that risk you also get higher return potential. These emerging economies have a higher growth trajectory, similar to what Ireland experienced in the 80s. Up to then it would have been a laggard and then its growth trajectory was much stronger than the rest of the stock market.

There are certainly benefits to emerging market exposure. It brings exposure to some very important regions of the world and some sectors aren’t captured in the developed market index.

China appears to be the only region of the world apart from the US West Coast that can produce those megacap companies that can dominate their market. A business like Temu for example.

Yes, and you might see that being the case increasingly with India too. If you look the rising middle class in China and in India in terms of adoption of western technologies, cars per capita and so forth, by buying emerging market equities you’re buying into that growth story.

Tell us about the third index in Prime Equities

The last index is small cap or small capitalization. The market value of these companies means they don’t make it into the main global index. These companies can still be worth around a billion Euros in terms of market capitalization – so they are not what we would call small companies in an Irish context. But a lot of these companies are in an exciting growth trajectory.

If you’re buying into small cap companies, you’re buying into the organic growth of that company. The aim is to own a company still in a strong growth phase and not having saturated its market yet. So it’s a different dynamic than mainstream equities.

We are recording this in late Q1 of 2025 and there’s a real interest in small and midcaps. Megacap technology has had a very good run over 18 months, and there’s a new focus in US markets on America First and helping domestically oriented businesses which suddenly are finding their European or Asian competitors facing tariffs.

At the same time, globally interest rates beginning to be cut, and smallcap companies tend to have debt-fuelled growth rather than big cash reserves, so may may find life a little bit easier in the kind of environment over the medium term.

The idea is that they’re generally a little less sensitive to the general economic cycle. Their own growth makes up more of their trajectory than just generally how the economy is doing. So perhaps ironically the smaller stocks can be a little bit more insulated than the larger stocks

You mentioned earlier that the bond market is far bigger than the equity market, and is a core part of investments for many people in Ireland, particularly in the period approaching retirement [link] as they tend to become a bit more risk-off and focus on the lump sum coming out of their pension.

Tell us about the bond exposure in the Prime funds.

There are two main types. When people purchase government bonds, they’re lending money to the government. At the moment that offers a pretty decent return because interest rates are relatively high. The second type is corporate bonds, where you’re lending money to a company. Because companies can’t print their own money and don’t have the ability to raise taxes, you get compensated with a higher interest rate interest rate payment from those corporate bonds.

We have exposure to both types those in Prime. What we’ve done very purposefully over the last number of years is to invest in what are called shorter-dated bonds. The interest rates they are paying are quite attractive. They’re the same or more the longer data bonds where you get your money back in 10-, 15- or 20-years’ time, but they’re less volatile.

So you’re getting the same amount of return but with less volatility. And that brings a higher level of stability to your portfolio while still generating a good income.

We’ve also expanded into emerging market bonds. It’s a similar story to equities: you get a higher interest rate payment because the growth trajectory is expected to be stronger. The currencies of emerging markets should also appreciate over time as people trade with them more and there’s more demand for that currency.

So there’s a lot of different bond asset classes, and that’s one of the benefits of SSGA having that €4.7 trillion in assets under management. We have scale in these areas and dedicated experts in more niche asset classes.

Investors are looking Euro for Euro at the risk-adjusted return. If you can get that same return by taking less risk that’s obviously a huge benefit to your investor community.

That’s how we go about constructing the funds. The first part of the process is assessing which assets rank best Euro for Euro. How much return are you getting per unit of risk?

That gets put into a quantitative process to determine the mix that will generate the best return. We’re considering questions like how these assets interact with each other? Is there a sufficient level of diversification? That gives you the best balance between not having too risky a fund and not being over-exposed to one single asset class but getting a really good level of return.

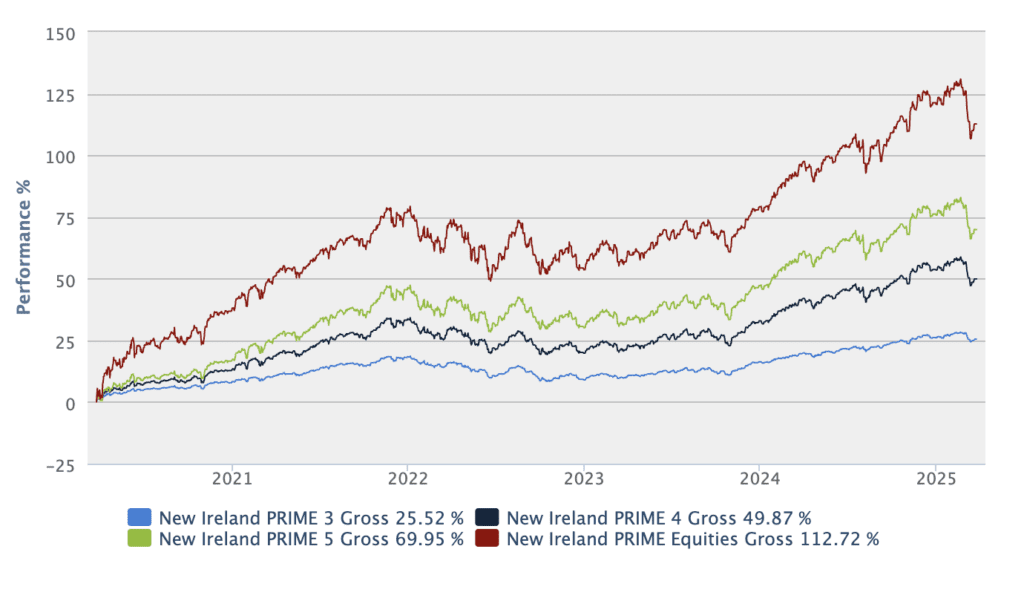

SSGA New Ireland Prime fund performance, last 5 years

Source: Longboat Analytics

We’ve discussed equities and bonds. Tell us about other asset classes in Prime 3, 4 and 5.

Bonds, equities and cash are often referred to as the traditional asset classes. Anything else outside of that would be alternatives. That can be property for instance. We have a 6-8% allocation to the New Ireland property fund (which is also managed by SSGA) in Prime 3 and 4. That invests in direct commercial property holdings across Ireland, the UK, France and the Netherlands. It owns offices, retail and logistics property, so very well diversified and delivering rental income. It offers a different return profile through rent roll as opposed to just capital appreciation.

Other alternative asset classes are commodities such as oil, gold and so forth. They are attractive because typically when inflation goes up some of these asset classes offer protection.

Lastly, there is a relatively modest exposure to what we would call infrastructure: toll roads, bridges, airports – anything that has a relatively stable income that’s backed by a physical asset.

We have said that that these are index funds: so how do you buy bridges and airports on a passive basis?

We don’t buy the physical assets. We buy companies that manage these assets and those companies then have a very stable inflation-linked return, because they’re collecting these tolls and the operating costs are pretty steady.

In terms of alternative assets, State Street Global Advisors, like all the major fund managers, is producing cryptocurrency ETFs in the US.

So if we look into the future composition of the funds, do you see that asset mix changing? How do you think that’s going to pan out in a European context where regulators have been slow to even allow those kinds of assets within conventional funds?

We do review these funds every year formally to make sure the asset allocation is still fit for purpose. That raises questions about what new assets are out there that we can invest in that are suitable for the fund.

I think our view is that it’s a little bit early to include crypto in portfolios like this yet. It doesn’t have a reliable history and the asset is just too volatile to put in a portfolio like this. As we say, you’re trying to get a good level of return for your risk. With cryptocurrencies, the risk is so high that it would just distort the level of risk in the portfolios to have any sort of meaningful allocation. There also isn’t strong regulation around it in Europe.

In the US we have launched some cryptocurrency funds, but those are very much if an investor themselves wants to gain that exposure. Some people have done very well out of cryptocurrency but we can’t figure out yet the exact characteristics of the asset and how it performs over different time periods reliably to include it in a risk-managed fund.

Certainly if the Prime 3, 4 and 5 are targeting particular levels of volatility, there’s no doubt that any serious crypto exposure could run a coach and horses through any of those plans!

Speaking of risk, it’s a feature of markets over the last couple of years that the US megacap technology companies and perhaps a couple of other similar companies in pharma have come to dominate index funds. You need to go back to the 1980s to find a period where so much of the stock market was invested in so few companies.

That presents our customers with a question. It’s not that many of these companies aren’t brilliant: they’re obviously world-beating companies with great growth prospects, growth histories, margins and products.

But the problem is that they risk all getting hit at the same time. For example if there’s a reassessment of the optimism around what artificial intelligence can do, then several of the biggest companies at the top end of index funds are likely to be affected.

How do index funds work through that risk? Are there benefits to being in an index fund in that context because you have whole-of-index exposure?

It’s a very relevant question. When Deepseek came out of China in January a lot of the American tech companies’ valuations fell.

We look at a risk at an overall level. We do manage the equity risk in the fund by monitoring how volatile markets are. If that spikes significantly, we reduce the equity content, because when volatility increases that’s normally indicative that there’s a higher proportion chance that markets will fall. As a result we try to protect investors by reducing the equity content until things are a little bit calmer. That’s all done on an automatic and systematic basis based on 20 years of equity market research.

Secondly, looking at the top holdings is very valid. But look at the top 10 holdings 10 or 15 years ago and you will not see, for example, Apple, Meta or Nvidia. And if you hadn’t had an index exposure, you may not have had exposure to those funds.

With an index fund, while you are exposed to the largest holdings, you are also automatically buying in to the next growth story, the next emerging technology, the next sector – which we may not even exists right now.

You own them on the way up as well as when they get to the top of the index. As an index investor you get exposure to the long tail.

If one thinks a business like GE that was at the peak of its powers around the turn of the millennium: it’s a shadow of its former self. And by the time you and me are drawing down our pensions I guess it’ll be another bunch of companies in that in that top 10.

You must be logged in to post a comment.