Investing your money in the first half of 2025 was a lesson in the basics. If you chose to spread your money among different geographies, asset classes and industries, and stuck to your plan, you’ll have done all right.

If you made major changes, things could have gone either way. On any given day, things were often volatile – and there’s certainly more of that to come. Events are moving fast. But for many investors in Ireland, the best reaction is to slow down.

Read Moneycube’s midyear market review 2025 to get our take on the year so far, the outlook from here, and understand where we see risk and opportunity in the months to come.

A volatile ride in the first half of 2025

It’s impossible to discuss the last six months in markets without mentioning tariffs. The US announcement of a huge range of tariffs on imports on 2 April prompted a major market selloff. Much of the tariffs announced were later walked back, or put into a holding pattern until at least 8 July.

Just a week after the tariff announcement, on 9 April, the S&P 500 rose by more than 9.5% in a single day as the tariff plans were paused.

Investors who had sold out in the wake of the initial announcements missed out.

But investors were right to remain apprehensive. The on-again off-again tariff announcements translated into many days with quite dramatic movements.

Winners in the first half of 2025

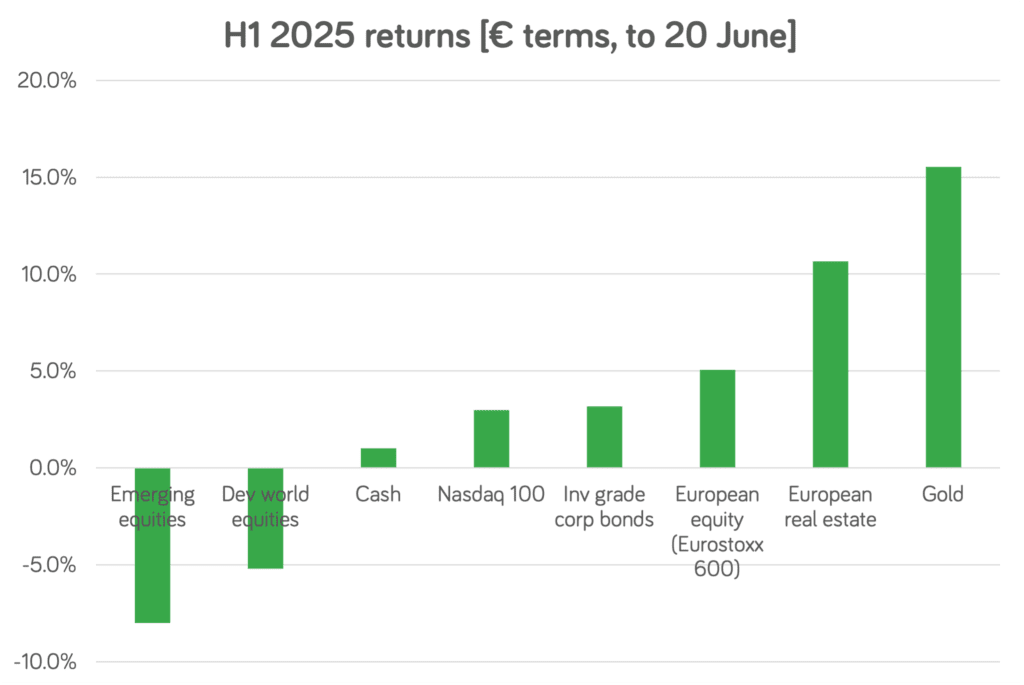

There were certainly routes to making money in markets in the first half of the year as the chart shows.

Sources: fund providers, MSCI, FTSE Russell

The leader of the pack was gold, an asset we highlighted in March.

Having risen over 35% in 2024, gold is up more than 15% in Euro terms in 2025. The rise of gold – and other precious metals like silver, platinum and palladium – tells us something about investor sentiment right now.

Gold has long been used as a safe haven asset, sought after as a store of value in inflationary or uncertain times.

What’s unusual this time is that stock markets have also fared pretty well. Sure, global markets – led by the US – are down in Euro terms. But in dollar terms, the S&P500 is marginally up for the year to date. And European stock markets, as measured by the Eurostoxx 600 of top European shares, is up more than five per cent (in Euro terms) since the start of this year, with defence a particularly strong sector as Europe invests more in its own military capability.

Another European sector displaying strong growth in the first half was real estate, buoyed by German plans to invest in infrastructure, as well as falling interest rates in the Eurozone and the UK.

Mixed fortunes for some recent favourites

If Europe was a bright spot, some recent outperformers lost a little of their lustre in the first half of the year. Artificial intelligence, the big talking point in 2023 and 2024, reeled in January from the release of Chinese competitor DeepSeek, which could seemingly produce similar results at a fraction of the cost and computing power.

Nvidia, the greatest beneficiary of investor appetite for all things AI, lost $593 billion in stock market value – the most of any company ever. Its shares remain up 4% year-to-date.

Other star performers of recent years, such as Apple and Alphabet, are down more than 10% this year so far – and much more in Euro terms.

At the same time, some unloved sectors had their day in the sun. For example the Eurostoxx bank index was up more than 35%.

It was a reminder of the value in spreading one’s investment across different sectors and geographies.

Where to from here?

Few people at the start of the year thought that Europe would be the star stock market performer, or that the US bond market would become a lot less attractive to international investors.

Similarly, the second half of the year is also likely to contain some surprises. Moneycube sees three key trends continuing to unfold.

Economic growth – but slower

Firstly, the global economy is softening. The impact of tariffs, general uncertainty, and war in the middle east and Europe is taking a toll. Businesses and households alike are less likely to spend their money, or borrow to invest, in such circumstances. As a result, Morgan Stanley now forecast global growth of 2.9%. This not a recession – but it’s the weakest growth since 2020, and compares to 3.3% last year.

For many Irish investors, this means it’ll be sensible to maintain an allocation to assets which are less correlated to the stock markets, including short-dated bonds, infrastructure, and commodities.

US dollar falling

Next, to Eurozone investors, the value of the US dollar is having a major effect on investment performance. The US administration has a stated policy to reduce the value of the dollar. In the first half of the year, the dollar fell by over 9.5%.

Put simply, a US stock that grew by less than 9.5% in the first half of the year is flat or loss-making for a Eurozone investor. Berkshire Hathaway, for example, is up a creditable 7.5% so far this year. But to investors in Ireland, it’s showing as a loss.

There are a variety of possible responses here. Some investors will be tempted to push in to US assets at a point when the dollar is cheaper than it’s been since 2021. That may prove risky if the US continues to support dollar devaluation, and in the light of questions around the US’s credit rating and debt levels.

Others see a gradual shift of institutional money out of US markets into Europe and Asia and are looking to invest in those markets to get ahead of the trend.

Geopolitics is creating volatility

Thirdly, geopolitics will continue to influence events, and short-term market moves.

A key question at the start of the summer, for example, is the oil market, and its effect on the wider economy. Oil isn’t the force it once was in the global economy, as we’ve written elsewhere. So a 1970s-style crisis seems unlikely. But a spike in oil will fast filter into business costs, and could easily set back the progress in taming inflation that’s been made over the last 18 months.

Whether it’s tariff to-and-fro, or middle east tensions heightened and then reduced, it’s more important than ever for investors to separate out short-term noise from the long-term changes that are taking place.

2025’s not over yet

Reading the news, it can feel like events are flying past. There are many forces at work prompting investors to react quickly: copy traders, political leaders, or busy newsrooms.

The challenge is to slow down and stand back a bit. Halfway through the year, and halfway through the decade is not a bad time for that.

If you’re truly investing you’re operating on a timescale of at least three years – ideally many more. That means you have the luxury of time. Stick to the plan, and don’t let these voices force the pace.