I pay €600 into my pension each month. But money is getting tighter – and on top of that, my pension’s performance has been woeful this year. Should I stop paying in until things settle?

– Anon

With inflation above 9 per cent, cutting costs is sensible. It’s tempting to reduce your monthly pension commitment: the amount is substantial, and you’ll feel an immediate cash benefit by making a change today.

But it’s likely that your future self will regret it.

There are several reasons that pulling back your pension payment should be among the last cost-saving actions you take.

1. Loss of tax benefits

Firstly, you’ll lose out on the tax benefit that powers your pension. If you pay top-rate tax, you’ll be receiving a €400 top-up to the €600 of post-tax pay you add each month.

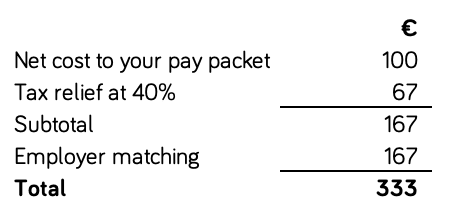

2. Loss of matched contributions

Secondly, if your employer matches your contributions, you may miss out on those too. Combined with the loss of tax relief, that could mean a €100 reduction in your personal pension contribution results in a €333 loss to your pension pot.

Here’s the maths:

3. Missed compounding opportunities

Thirdly, a big part of the value of your pension comes from compounding investment returns over time. Even if you pay the money in later, it’s less likely to generate the same value, because it will be invested for growth for a shorter period.

Of course 2022 has tested every investor’s patience, so it might not feel that way just now. But no-one can predict when a recovery will come – July was the best month in the markets for two years, for example.

So stick to the plan if you can.

So what can you do?

The reasons above don’t mean you shouldn’t look for ways to improve your pension. If you find yourself asking, should I reduce my monthly pension payment, it’s likely something needs fixing.

You say the performance has been poor. This is worth investigating. Does it arise from excessive costs, or inappropriate fund choices perhaps? A good advisor will help you benchmark your pension and look for ways to improve it.

And clearly if the monthly commitment is forcing you to make cutbacks to basic needs, or pushing you into expensive (i.e., non-mortgage) debt, then it is time to reduce the cost.

Cut other expenses first

Starting with discretionary items is obvious. Reducing regular monthly outlays is attractive because it delivers an ongoing benefit. Look for unnecessary direct debits. Simply scan your online banking to see what you’re on the hook for.

If you do need to pull back on financial items, focus on shorter-term investments with less tax benefit than your pension, or even redundant costs, such excessive insurance cover.

Lastly, if you do decide to reduce your pension payments, bear in mind that you may be able to catch up later as cost of living pressures abate. You can claim tax relief on pension contributions from this year’s earnings as late as October 2023.

This question of the month is adapted from a Moneycube article which appeared in the Sunday Times on 21 August 2022.