I’m aiming to retire towards the end of 2025. While I’ve been reducing the risk exposure of my pensions, I’ve kept some in bonds and equities which went up significantly in value over the last year (around ten per cent to €600,000, split about evenly in two pensions).

After such a good run, should I alter my plans? In particular, should I accelerate drawing down my pension? If I do, what are my options?

– Anon

There’s no doubt 2024 was a strong year for markets. So if your money was invested in risk assets, you’ll have seen meaningful returns. What’s more, that trend has continued in the early weeks of 2025, with European stocks in particular showing strong gains.

As retirement approaches, you’re right to review your investment strategy. The key near-term question is regarding your retirement lump sum. Most people can take 25% of their pension as a lump sum at retirement. So a sudden reduction in the value of your pension in the run-up to getting hold of it it has a direct impact on your lump sum.

That’s the main reason many pension savers choose to de-risk their investments as they approach their drawdown date.

Once you’ve taken your lump sum, by contrast, it often makes sense to increase the risk-reward focus of your retirement money within an Approved Retirement Fund.

While many of us hesitate to take that step initially, it’s worth remembering that your funds in retirement need to last many decades. Failing to give them adequate scope for growth can lead to their value dwindling and failing to keep pace with inflation, fees, and the income you’re drawing from the pension.

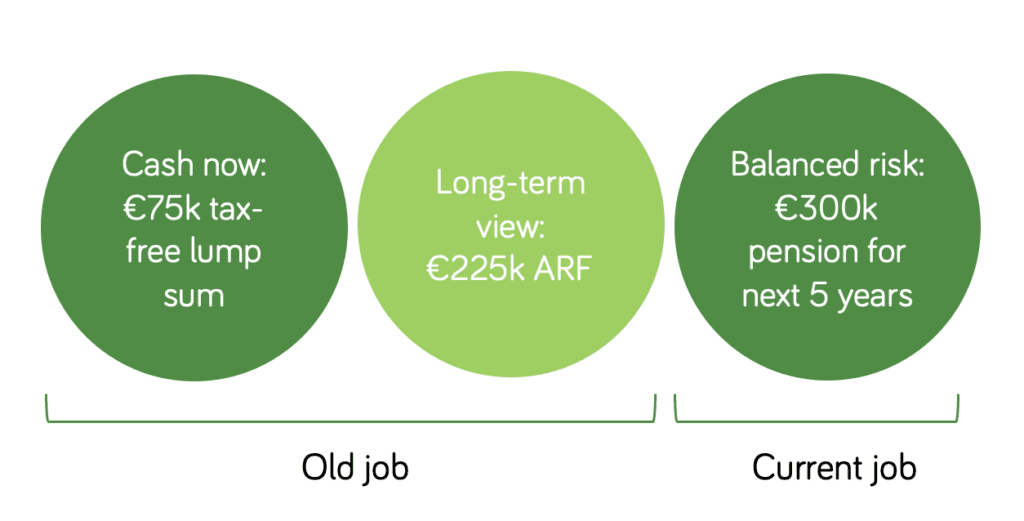

So what are your options? To answer that, we’ll assume that you are planning to take 25% of your pension as a lump sum, and that one of your pensions is from an old job, and the other from your current one.

Here are three broad approaches you should consider.

1. Lock in your gains

This is the traditional route taken by most people in the years before retirement: gradually moving into lower-risk, lower-growth assets. As you are counting the time in months rather than years, a material dip in market values now would hit your retirement lump sum hard. Your money would have little time for asset prices to recover.

You can avoid this risk by moving your money (or most of it) into cash, with a view to drawing both your pensions towards the end of this year.

This approach offers the advantages of simplicity and certainly.

The obvious downside to this approach is that your pensions won’t participate in any market upside over the coming months. If you had done this over the last six months, for example, it would likely have reduced your pension value by some tens of thousands of Euro.

2. Hold your nerve – for some of the money

A more sophisticated strategy would be to make separate plans for your old pension, and the current one.

You might decide, for example, that by retiring the pension from your old job at the end of the year, along with savings and the State pension, you won’t need your second pension for half a decade to come.

If that’s right, you can afford to hold your nerve to some extent with the pension from your second job. You could leave that pension invested with some prospects for growth, while moving the pension from your old job into cash.

Of course, that still means that half your pension wealth is earning very little, while sitting in cash until retirement.

3. Accelerate the pension from your old job

That gives rise to a third approach. As you say yourself, markets have had a strong run over recent months. Although there are reasons for confidence, given your timescale, there is a question of the balance of risk versus reward. You could conclude that for the remainder of this year, there is more downside risk than upside return for your pension.

If that’s right, there is a strong argument for accelerating the retirement of the pension from your old job.

Assuming you’re over 50, there’s no need to retire from your current job in order to draw down the pension from your old job.

As the diagram suggests, you can draw your lump sum now (which will be free of tax based on the size of your pension). What’s more, you can consider dialling up the risk-reward potential for the remaining 75%, assuming you invest it into an Approved Retirement Fund. Remember: this is money you’ll be using to fund your pension for many years to come.

Having done that, you can re-assess the fund allocation for the pension in your current job, taking a balanced view now that the ARF is invested in higher risk-return assets for the long term.

You must be logged in to post a comment.