If you work for yourself, funding a self-employed pension is something that can get left behind. There are plenty of competing demands on your cash, especially in the early years of trading. Here’s how you can make a start on your pension if you’re in your 40s and self-employed.

Some good news to begin with

The good news is that the tax system gives some handy privileges to self-employed people.

The advantages are greatest if you trade using a company (ie, you’re technically employed by a company which you control or direct). If you use a limited company, the contribution limits are considerably more generous than the age-related limits for employees. In fact, there is almost no practical limit. That means that it’s possible to build up pension assets very quickly, and save a lot of corporation tax, PAYE, PRSI and USC in the process.

If you’re a sole trader, you are subject to age-related limits. But you can use a personal pension, which can be better value than a PRSA or occupational pension put in place by an employer.

What that means is that you have lots of scope to catch up on your pension for the years you’ve missed. You can also likely make a chunky lump sum contribution – for example, if you experience a year of exceptionally good trading. We’ve explained some of the practicalities of self-employed pension lump sum contributions below.

How to go about your pension

In fact, that’s exactly the way many self-employed people sort out their pension. We often recommend a two-pronged approach.

First, set up a regular monthly amount so that you’re building up retirement wealth all the time.

Secondly, get into the habit of sending a lump sum towards the end of your financial year once you have visibility on what your earnings will look like.

So how much should you pay into your pension?

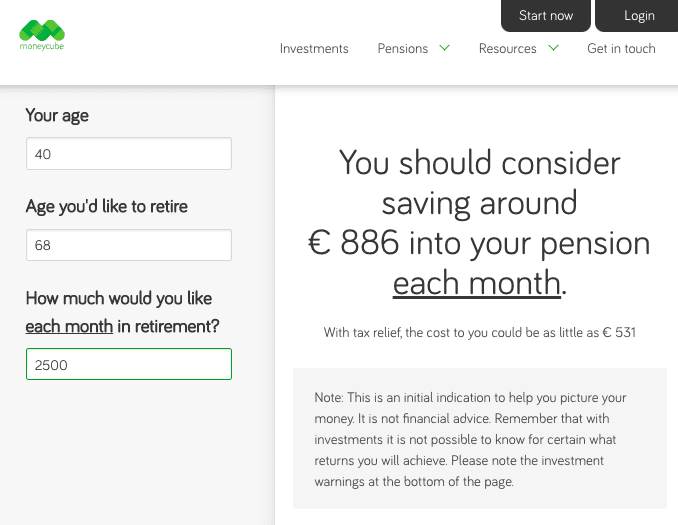

If you’re starting your pension in your 40s, there is some catching up to do. Take a look at our calculator to get an idea of what you’ll need.

Remember of course, that tax relief on the money you pay in will propel the value of your pension pot by as much as 67% straightaway.

The example below is based on starting a self-employed pension aged 40, in Ireland, and planning to retire aged 68. If you’re a top-rate taxpayer, an after-tax pension contribution of just over €500 each month (that’s €886 before tax relief) could set you up for income of around €30,000 in retirement.

Starting’s the hard bit

If you’re considering starting a pension in your 40s, don’t get too hung up on the numbers. The hardest bit is to make a start.

Your contribution, however modest, will still benefit from income tax relief, tax-free investment growth, and a tax-free lump sum on retirement. You can always increase it over the years ahead.

Interested to get going? Just fill in the form below and we’ll be happy to help.

Lastly – consider a lump sum – and do it before your year-end

There’s no getting away from the fact that more is more when it comes to pensions. It doesn’t have to be right at the start, but if you have some catching up to do, adding a lump sum from time to time is a great way to accelerate your route to retirement.

If you are adding a lump sum, it’s best to plan it some time ahead of your company year end. If you’re, say, ten months into your company’s financial year, you should be able to get good idea of the spare cash you can afford to take off the balance sheet.

While it’s possible to accrue a bonus or additional pay, and make the payment after your year end, pension contributions are different. In order to set your lump sum pension contribution against corporation tax, you’ll need to pay that sum across within the financial year itself. You can avoid a year-end pension panic – especially if your year end is 31 December, by planning a little in advance for your lump sum pension contribution.

You must be logged in to post a comment.