In many ways, Ireland is richer than it’s ever been. For the first time, many families have significant wealth to pass down the generations in due course. That’s surely a good thing – but it also creates new questions and a need for families to plan and have open conversations about money.

Money conversations can be awkward at the best of times. No-one wants to appear greedy, and it’s hard to know where to begin. This is a starting point.

Note: this is the second article in a two-part series on inter-generational wealth. For How to talk about money with your parents in retirement, click here.

Why money conversations with your adult children are needed now

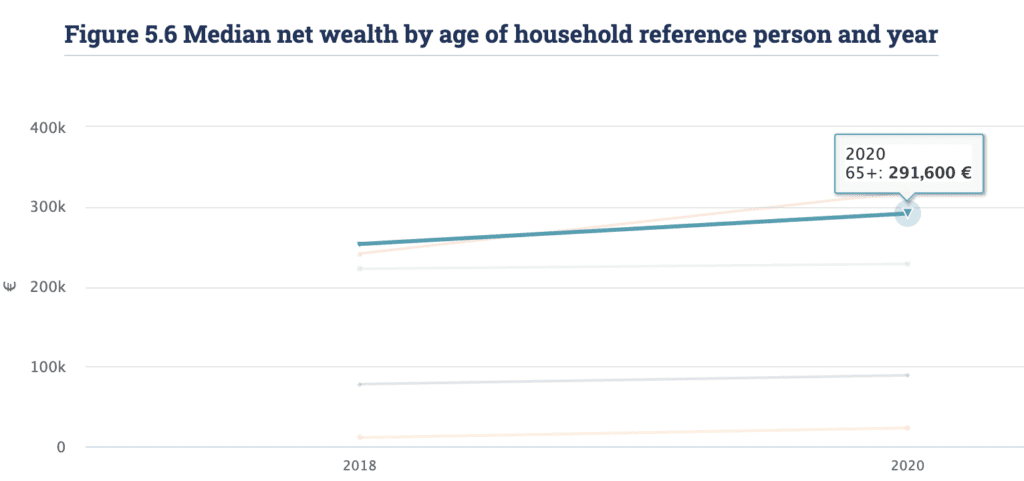

Although attitudes to money are formed early in life, we’re not talking communion money here. There is a lot of money at stake for many families in Ireland as assets start to pass down the generations. And wealth among the over 65s continues to rise, as the chart indicates.

Source: Central Statistics Office

It’s a new phenomenon for many older people, who themselves may have received little money from their parents. That’s changed as Ireland has got richer, and families have got smaller. Fact is, by 2020, more than one third of households had received an inheritance, and the frequency of inheritances appears to be increasing.

The challenge for families is for this transfer to be useful and planned. Family finances need to remain dependable and well-managed as people age, while younger generations have a need to minimise inheritance taxes and (if it’s available) potentially receive money when it is needed most.

Here are five key topics to discuss.

1. Set the context

The stage your kids are at will make a great deal of difference to the conversation you’ll have. Depending on the situation, you can set the scene for a periodic conversation on family finances over a period of years. That could include:

observing how they handle their own money and considering how that affects your plans to share it with them

questions of fairness of wealth distribution between your children – for example if one were funded to pursue education away from home

showing your children how you accumulated wealth, including periods where family money was tight or at risk

2. Help them sort the basics

As we’ve said elsewhere, done right, a financial plan cuts stress, improves your finances, and helps you achieve your major goals in life.

You can give your children a good start in their financial lives by helping them focus on the big financial questions. That typically includes avoiding expensive debt, creating an emergency fund, obtaining life assurance if they have financial dependents, and starting a pension.

3. Don’t become a source of bailouts

That said, don’t feel obliged to become the Bank of Mum and Dad. Even if there is extensive family wealth, for the sake of their own wellbeing, your children need to go their own way.

It’s natural to want to lend a helping hand at critical times for your children – perhaps when buying a house, or starting a family.

But making sure your own position in retirement is secure must be your first priority. And repeatedly bailing out your children from financial problems can store up trouble and weaken a parent’s financial position – particularly if it’s done when you are approaching retirement or in retirement, and have limited opportunity to rebuild the loss of wealth.

4. Be clear on how you want to distribute money

A will directs how your assets should be distributed after death. Almost everyone should have one. It makes sure things are done as you’d wish, it is kinder and faster to those who come after you to deal with things, and it reduces the scope for disputes. For most people, using a solicitor to draw up the document makes sense.

Although how you choose to distribute your assets is your own business, at a minimum it’s wise to let your children know where your will is held. For many people, explaining at the right time who the executor is, and how assets will be shared out, is a practical step which can make things easier for your family and avoid future conflicts.

5. Consider the right time to pass on assets

Capital Acquisitions Tax – aka inheritance tax – is costly for many families in Ireland. The current rate of tax is 33%. If assets are illiquid – for example property – you may need to consider where the cash will come from to settle the bill.

Many people can do some simple tax planning to reduce an eventual Capital Acquisitions Tax liability. Here are three approaches to consider.

Should you accelerate the transfer of assets? Recent changes to tax thresholds mean a child can receive a gift or inheritance from their parents worth up to €400,000 with no tax to pay. That’s true whether a gift is given in life, or an inheritance is received on death. For some families, it makes sense to pass on this wealth sooner rather than later.

The small gift exemption can also reduce eventual inheritance tax costs. This tax break lets anyone give another person up to a €3,000 per year gift without triggering a tax charge for the giver or the receiver. €3,000 may not sound a huge number, but it rapidly adds up. For example, two grandparents could give €3,000 per year to two children, their partners, and four grandchildren. That would steer €48,000 away from the inheritance tax net for each year it’s done.

Lastly, it’s possible to set up life insurance to settle expected future Capital Acquisition Tax bills. This isn’t appropriate for everyone, and can be expensive, but in the right situations, can help manage inter-generational wealth. Specialist advice is needed, above all for the person paying the premium, in these situations.

Last word: If you found this useful, you might like our second article in this series, How to talk about money with your parents in retirement.