Russia’s invasion of Ukraine is above all a humanitarian tragedy, with several chapters yet to unfold. The reactions of the financial markets today – and over recent weeks – have reflected the fast-moving nature of the crisis. What are the implications for investors?

Today’s events in the markets carry an important lesson. At the start of trading, markets reacted in a predictable way to the news from Ukraine: there was a sell-off of risk assets (mainly equities), and a flight to the safety of government bonds and the US dollar.

Oil and other commodity prices spiked (Ukraine and Russia make up more than a quarter of the world’s wheat exports).

But as the day wore on, and western policy responses emerged, there has been a recovery and in fact the S&P500 closed up 1.5%, and the Nasdaq 3.3%.

Today’s downs and ups are a reasonable indicator for what’s to come over the next few days and weeks. Volatility will be with us for a while.

So, what’s our advice this week? Well, it’s largely the same as our advice last week.

Stay the course

There are lots of reasons why doing nothing is the best approach.

Above all, if you were investing on sound principles last week, you are investing on sound principles this week.

Sound principles include investing for growth over the medium and long term, putting your money in diverse assets, and keeping your costs low. Staying true to this leads most investors to conclude that the best reaction is no reaction.

As Holly Mackay of Boring Money once put it, “The best advice I can give anyone in such times is to forget their online trading password”.

Panicking costs money

Remember that selling has costs too.

Selling your investment now means you will almost certainly incur early taxes, possibly trading costs and (if you’re with one of our competitors) early exit charges.

Then there’s the danger of missing the bounce-back – exactly what happened by the end of today had you joined the sell-off this morning.

It’s well-known that many of the best days in the market come after some of the worst days. The trouble is, it’s often new investors who sell out at bottom by reacting too quickly. This article has a great chart of the costs of panicking compared to playing it cool (it says panicking costs over 35%!)

Is there anything you should do differently?

Here are three simple checks you can run on your investments right now.

1. Make sure you have some diversification in your portfolio

Investing through a well-diversified fund, or selection of funds, containing a mix of property, bonds and commodities will help stabilise your investments. A multi-asset fund where the fund managers rebalance to maintain the same risk/ reward profile over time is ideal for this.

2. Consider drip-feeding your investment

Many funds have a facility to drip-feed your lump sum over six or 12 months. (In finance-speak, this is called Euro-cost averaging). This way, you’ll never end up buying at the market peak, because the price will average out over the six or 12 period you choose.

3. Make peace with the ups and downs

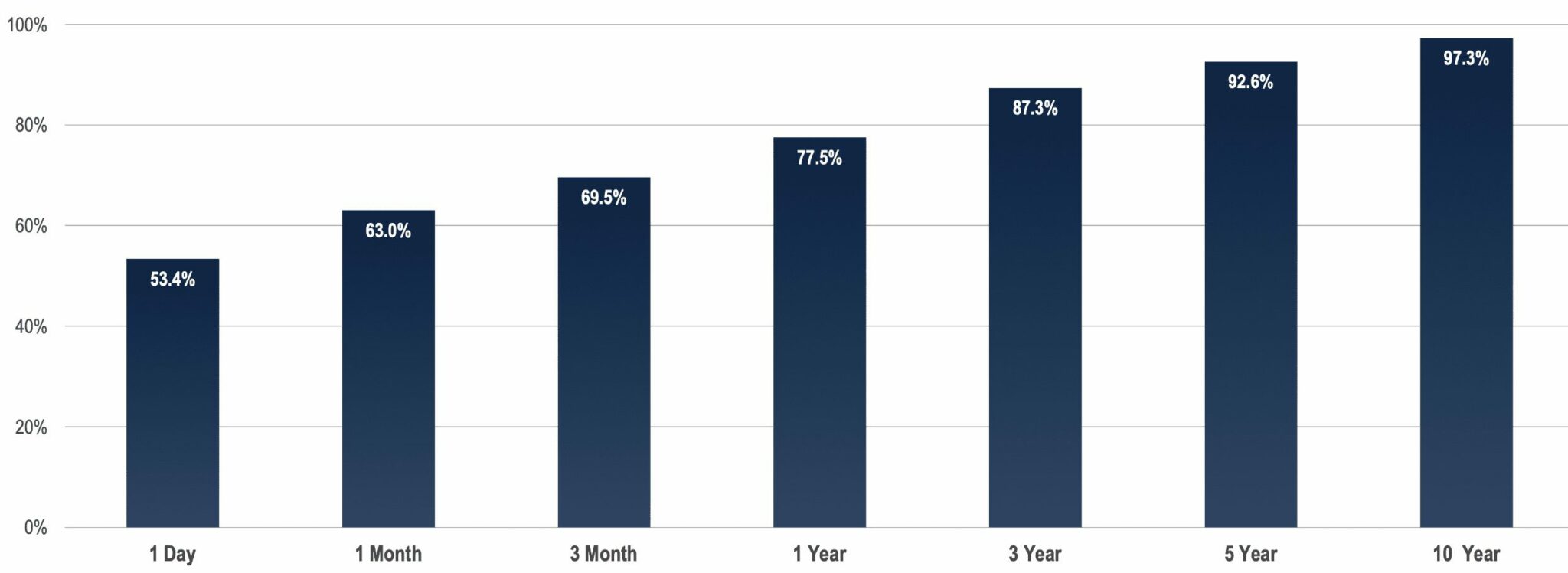

Here is a chart from fund managers First Trust showing the likelihood of positive returns in US markets over the last 85 years.

While the prospect of a positive return in the markets over the short term is only a little over 50:50, what’s clear is that the probability of growth over any sensible timeframe (ie 3 years and more), is extremely high.

So what’s the smart advice: hold your nerve.