Rebalancing is the process of adjusting your investments between different types of assets. It’s best explained by an example.

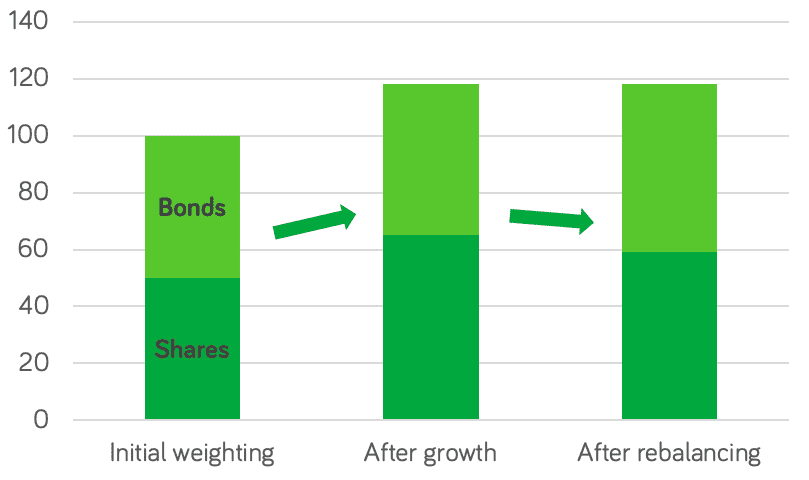

Imagine you had originally bought a portfolio of investments, split 50:50 between company shares and bonds. (See the left-hand bar on the chart above). You then plan to leave it some time to do its work, growing over the medium term in the markets.

What happens next?

Roll forward two years (two good years, admittedly), and perhaps the shares have grown by 30%, and the bonds by 6%. (See the middle bar on the chart).

If you took no action, your portfolio is now weighted 55:45 between shares and bonds. That will affect the overall volatility, risk and growth profile of your portfolio.

If you chose to rebalance your portfolio back to 50:50, you would need to sell shares and buy bonds. As you can see on the right-hand bar on the chart, your portfolio has grown, but having rebalanced, you are back to your original 50:50 split.

How do I go about rebalancing my investments?

How you rebalance will depend on the nature of your investments.

At its simplest level, many multi-asset funds rebalance their portfolios on their investors’ behalf, in order to stay within certain target percentages of shares, bonds and other assets.

On there other hand, if you invest in a portfolio of funds and direct shares, alongside your advisor, you’ll need to perform this rebalancing work manually every so often if you wish to maintain a diverse portfolio.

Moneycube can help you decide the right asset split for your situation, and how to choose or adjust your portfolio to get there.