It’s less than three weeks since the US election, and already the ‘Trump trade’ has been through several changes. What is it, and what does it change for you as an investor?

What’s the Trump trade – and what’s the effect so far?

The Trump trade is the name for the rotation of money into assets which investors think will prosper under Trump’s presidency.

Perhaps the most surprising result from the 5 November elections is that they produced a clear result the following day. Many commentators and investors had speculated that it could take weeks for the result to be declared.

As it happened, there was no need for recounts or contentious debates, and the Republican party has also taken control of the Senate and the House of Representatives.

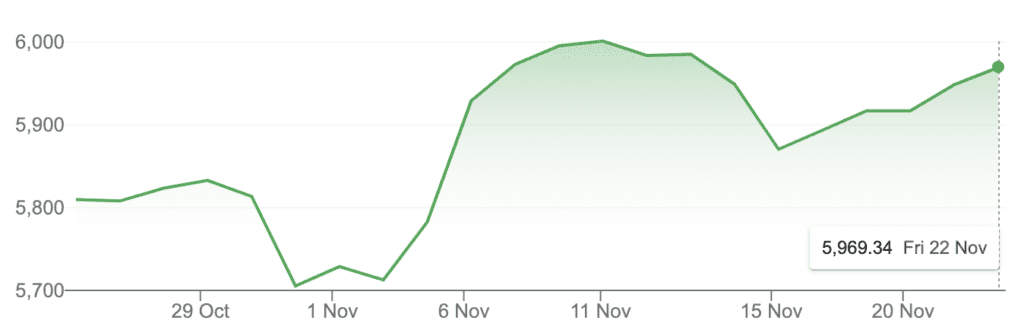

The election news led to an immediate boost for global stock markets. Pollsters had said the election was too close to call, so much trading was placed on hold until the fog cleared.

US markets in particular saw a lot of interest. Investors anticipated the domestic market will benefit most from Trump’s America First policies – which he has more power to press through the US Congress.

Less noticed was a sell-off the following week. By Friday 15 November, the S&P 500 was at a lower level than it had closed on 6 November – before recovering once more in the week to Friday 22 November.

Source: Google Finance

It’s going to take time

What’s clear is that it while be some time before the effects of Trump 2.0 on the global economy – and on investment portfolios – becomes clear. Certainly one can try to identify sectors that will do well in the new political reality. But even that is a risky game.

For example, many think the oil and gas sector will prosper under Trump’s watch. But ExxonMobil, the biggest US oil company, stayed flat on 6 November, and its share price has barely moved since. No Trump trade here.

Some asset categories – such as cryptocurrencies – have seen a major price uplift. But they may fall just as fast as events unfold in 2025 and beyond. Three-and-a-half years ago, Donald Trump referred to Bitcoin as a “scam against the dollar”.

It’s also becoming clear that Congress may not simply wave through the Trump administration’s plans, and that Trump’s cabinet picks may bring with them drama and uncertainty, as in the first Trump presidency.

So Moneycube cautions against radical changes in your portfolio at this stage.

Some likely winners and losers

That said, it is possible to identify some sectors that look interesting in the wake of the US election. Here are three.

US small- and mid-cap equities: US stocks in general have been buoyed by the election results. Investors sense that the ‘America first’ doctrine will harm other markets more than the US, and in particular that US companies which are focused on their domestic market will benefit if tariffs are placed on the imports of their international rivals.

European defence: it’s not for everyone, but in the wake of the Russian invasion of Ukraine, and US pressure on Nato members to increase their defence spending, European governments may significantly increase their military spend.

European bonds: if Europe’s export-led economy comes under pressure, and Germany continues to sputter economically, it’s likely Eurozone interest rate cuts will accelerate. That will drive a recovery in bond prices in Europe.

There are also some sectors that look pricey in the new environment.

If US small- and mid-caps are poised for growth, US big tech looks less attractive. Firstly, they may be out of favour in the new regime (for example, given Trump’s past antipathy towards Meta and Alphabet). There’s also the matter of current pressure from the US Department of Justice to carve out Alphabet’s Chrome browser from its main business. And while the growth and profits of big tech are immense, the valuations are simply very high at this stage.

The fact that Nvidia’s share price fell on 21 November after it announce a near-doubling in its sales versus the same quarter a year ago is an indication of how high expectations have become.

Other areas also look exposed. Ireland’s revenue base could be at risk, for example. Our reliance on US multinationals for corporation tax revenue and high-paid jobs could come under scrutiny as the US looks to reshore business activity and tax revenue.

And in the US itself, it’s easy to imagine the policies of cutting tax, introducing tariffs and deporting immigrants could lead to inflation, leading to increasing interest rates, faling bond prices, and putting pressure on the wider economy.

It’s early days

There’s no doubt that the Trump presidency will herald changes in geopolitics, the global economy, and in asset prices. And it’s possible to tilt portfolios now into assets which seem likely to benefit from these changes.

The contours of these changes are only beginning to emerge. Fund managers, advisors, and investors will need to take account of this over time. But what’s certain is that there will be plenty of twists and turns along the way. The potential upside of making radical bets on the Trump trade at this stage looks less than the risk.

As with all times of uncertainty, the core approach should be to stay diversified and hedge your bets across assets, geographies and industries.

You must be logged in to post a comment.