There’s a degree of optimism in the air in financial markets as the year draws to a close. 2024 has been a strong period for markets, and the overall mindset is one of growth. Company earnings have been resilient, inflation has been cut, and there’s a sense that there is more to follow for the short term at least.

So what should investors look out for in the markets in 2025? Here are five trends to consider.

Markets in 2025 will broaden

Share price growth over the last twelve months has been driven by optimism around valuations more than earnings growth. Evidence of falling inflation, and the prospect of interest rate cuts proved the spark for a re-valuation of profit multiples across markets from November 2023, especially in the US.

The artificial intelligence innovators, and megacap technology companies in particular are now on unusually high valuations. Expectations are simply very high. For example, when chipmaker Nvidia reported its quarterly results last month, its shares fell 5% on the news that it had merely doubled its sales versus the same period the year before!

But the reasons for reviewing valuations remain valid: inflation has been curbed without recession in the US or Europe.

It’s likely to spread more broadly in 2025. If 2024 has seen the ‘Magnificent 7’ prosper, in 2025 we expect the other 493 members of the S&P 500 to do some catching up, driven by improving valuation, solid earnings, and a focus on the US domestic economy. Well-established companies in Europe and Japan in particular could benefit from this revaluation trend.

For investors, owning midcap companies in the US, and mature dividend-producing businesses at more sensible valuations will be a useful balance to the tech focus that has led returns in 2024.

Rewards for tackling the hard stuff

China looks set to underwhelm again in 2025. Goldman Sachs forecast growth in real GDP shrinking form 4.9% this year to 4.5% in the world’s second-largest economy.

The threat – or reality – of heavy tariffs on Chinese exports to the US will hold back its export-led economy further next year.

And property prices in China continue to decline, arising from oversupply, affordability problems, and financial problems among developers. Further government measures will be needed before confidence recovers.

But restructuring has worked elsewhere. Many countries that have taken hard medicine in recent years are seeing results.

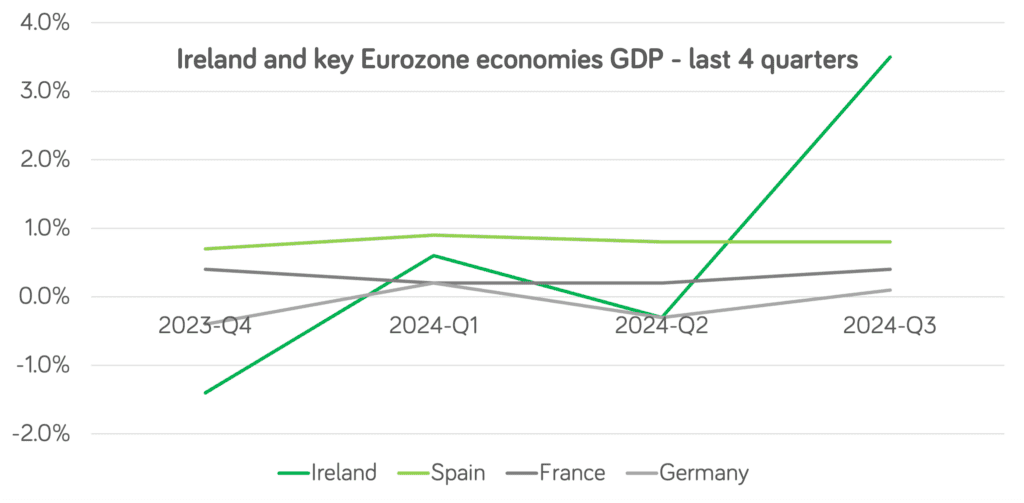

Portugal, Ireland, Italy, Greece and Spain were once called the PIIGS – now the PIIGS are flying. Ireland recorded the Eurozone’s highest growth rate while France struggles to pass its budget and Germany struggles to rekindle export-led growth, as the chart shows.

Source: Eurostat

This is filtering in to higher employment and lower government borrowing costs in economies which ten years ago were enacting difficult reforms.

It remains to be seen if Europe’s largest economies – France, Germany and the UK – have the stomach for something similar.

Interest rate cutting will help bond, equity and property markets

The European Central Bank cut interest rates to 3% last week, and is likely to cut further next year. It’s unlikely we’ll go back to the near zero rates of much of the 2010s, but the trend is definitely down.

Large sums of money will move out of cash in search of a return. Three sectors in particular are poised to benefit.

Property and infrastructure, which offer investors a regular stream of asset-backed income, will become relatively more attractive.

The stock markets will benefit from investors’ recognition that in order to gain a return, it will once again be necessary to take some investment risk.

Bond prices will rise: it’s an iron law of the bond market that falling yields mean rising prices.

Animal spirits in public markets

A growth mindset in markets makes it likely we’ll see higher levels of takeover activity in public markets, as well as the arrival of some large pre-IPO companies.

A revival of merger and acquisition activity will boost returns for investors who get taken out. For example, Aviva’s recently accepted offer to take over UK car insurer Direct Line is at a 73% premium to the share price before the deal.

There’s also a steady pipeline of companies which have delayed listing on public markets but may decide upon 2025 as the moment to strike. That list could include European fintechs like Revolut, Stripe and Klarna, as well as US-based TikTok.

With growth in vogue, and interest rates falling, private equity is also poised for a strong year. The IPO market will offer additional routes for exits, while lower costs of capital will support acquisitions.

Risks remain… as they always do

As ever, risks remain for investors in 2025. Geopolitics, as last year, could still make a fundamental difference. Miscalculations by Trump, Xi, and Putin are all possible, and the absence of strong and popular leadership in Europe will hold back growth.

Investors may start asking harder questions about artificial intelligence, and look for greater returns on the billions ploughed into AI chips over recent years. If they do, it’s likely their search will lead them to other areas positioned to benefit from the development of AI, which itself looks here to stay. That could include energy production and AI applications for example.

Despite risks therefore, 2025 offers meaningful opportunities for wealth accumulation for investors across numerous asset categories.