If you’re contemplating investing a lump sum, it’s natural to ask, is now the right time?

Pare it back, and there are really two questions here:

- Am I ready to invest?

- Are the markets ready for me?

Let’s take them in reverse order.

1. Are markets going to go up?

Short-term, this is impossible to answer. No-one knows for sure – and being willing to accept that fact is one of the reasons you’re paid an investment return.

Longer-term, we can be more definitive. The simple fact is, every fall in the investment markets in the past has been followed by a rise.

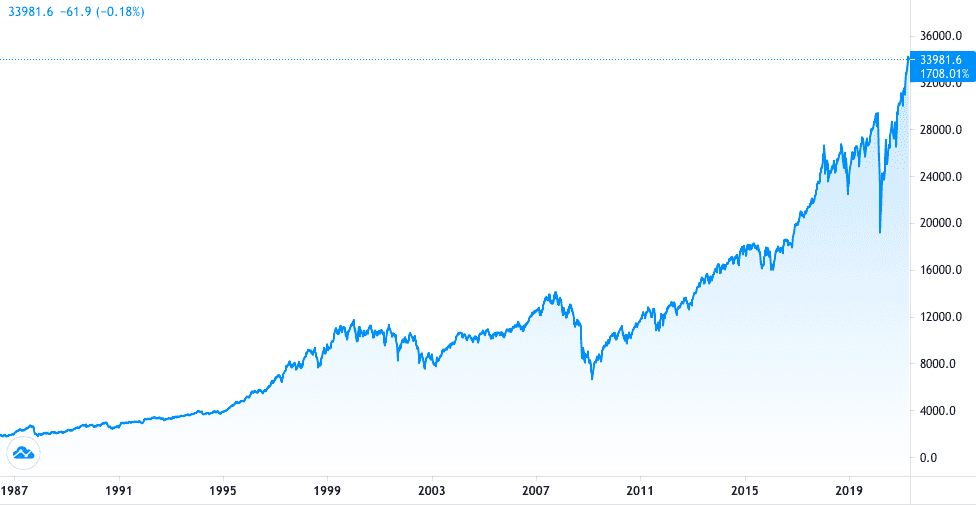

Here’s a 35-year view of one long-running US index, the Dow Jones industrial average, that says as much.

Source: Tradingview.com

If you’d invested at pretty much any time over that period, you would be in positive territory right now.

Remind yourself for a moment of the events this period includes. The collapse of communism, two Gulf wars, the bursting of the dot.com bubble, 9/11, the global financial crisis, and last year’s coronavirus-prompted dip: markets recovered.

Clearly some times to invest were better than others (read more about how to handle that risk). But if your timeframe was five years or more, there were few bad times.

2. Is now the right time for me to invest?

Now to the second side of the question. If you’re reading this, you’ve probably gone a fair distance to answering this one.

Here are three questions to test yourself.

Firstly: can you afford it? This isn’t simply a question of wealth. It means, have you got a lump sum, or are you able to commit to a regular investment, which you are confident you can tuck away for at least three years, and ideally longer?

Secondly, are you okay with bearing a short-term loss? Nobody likes losing money of course. But markets don’t move in a constant, steady way. If you’ve started to see this as part of the ebb and flow of investing, then you’re more likely to prosper.

Lastly, what’s the plan? Investing is about taking measured risks – it’s more than a punt. If you’ve a view on how much risk you’re prepared to take, how much you’re willing to invest, and a provider you trust, you’re well on the way.