Jan 2025 update: Our more recent post highlights the best investment opportunities for your money in 2025.

It’s time for Moneycube’s roundup of the best investments available in Ireland.

Below we look at five funds we think have strong potential – in 2018 and beyond. Remember all of these funds are available through our online investment platform.

Best fund for new investors

Moneycube believes multi-asset funds should lie at the centre of most investors’ portfolios.

Whether you are investing a lump sum, setting up a regular investment, or both, multi-asset funds are useful. In a single fund, you can achieve the diversification, flexibility and balanced growth potential that most people need from their wealth.

Zurich’s Prisma 4 fund is a strong option for many new investors. It gives exposure to a broad range of assets, split among equites (58%), bonds (21%), alternative assets (16%), and property (4%).

Prisma 4 is also spread over the globe. 55% of the fund is invested in the US, 22% in Europe, 10% in Japan, and 12% in Asia-Pacific and South America.

And importantly, it has a track record of decent returns. Since its launch over four years ago, this fund has returned an average of 8.2%, and has never had a loss-making year.

Best multi-asset fund for larger lump sums

For larger lump sums, Moneycube likes Morningstar’s Global Allocation Portfolios. Morningstar is one of the biggest names in the investing world. These portfolios give individuals access to world-class portfolios on terms normally reserved for big institutions.

The portfolios are actively invested in a range of exchange traded funds (ETFs) from managers like Blackrock, Vanguard, and State Street. Using ETFs like this drives down the cost to Irish investors.

Since its introduction in Ireland in June 2016, Morningstar’s Adventurous Global Allocation Portfolio has generated a return of 18.7%.

You can invest in these funds using Moneycube with a lump sum of €10,000 or more.

Best investment for income

Investors have been wary of the Eurozone since the financial crisis. A combination of slow growth, high debt levels and questions about the future of the Euro made Europe unloved.

But things are picking up. Many of the biggest economies in Europe are now firing on all cylinders. With companies reporting rising profits, share price and dividend growth should follow.

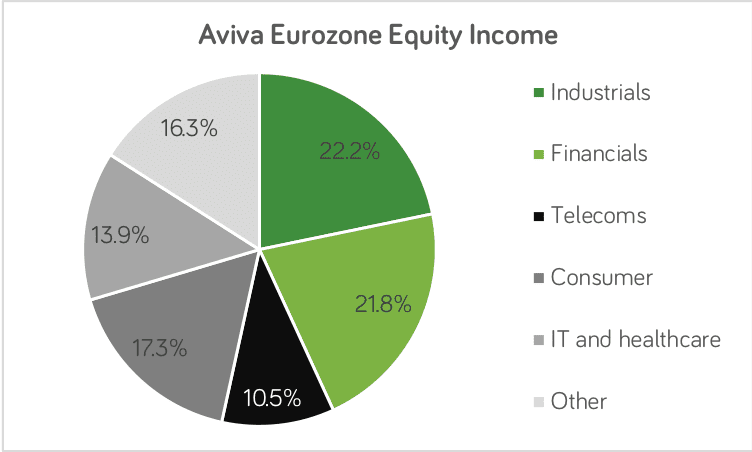

Aviva Eurozone Equity Income Fund offers access to this opportunity. The fund is spread well amongst industries, as the chart below shows.

The fund invests in well-established companies for dividend income as well as capital growth.

France, Germany and the Netherlands account for 66% of the fund’s investments. Global companies like Vinci, the construction group, Unilever (the owner of Dove shampoo and Lyons tea), and oil supermajor Total are among its biggest holdings.

Over the last five years, this fund has returned an average of 10.8%.

Best property fund

Irish property had a great year in 2017. But one of the problems with investing in the local market is that you can experience violent ups and downs.

You can easily invest in global property via an investment fund. This gives you exposure to property trends across the world.

We like Standard Life’s Global Real Estate Investment Trust fund. Its property investments cover shopping malls, hotels, nursing homes, and property management businesses. Marriott Hotels is one of its top ten investments.

55% of the fund is invested in the US, 24% in Asia and Australian, and 14% in Europe, making it one of the few funds readily available in Ireland which has truly global exposure.

Over five years, this fund has returned an average of 4.5%.

Best investment for exposure to emerging markets

If you want to access emerging markets like China and Africa, take a look at New Ireland’s Global Emerging Markets Fund.

Although this fund is tiny (at €6 million of assets), it is invested in the companies everyone’s excited about, including WeChat owner Tencent, Alibaba (China’s answer to Amazon), and Samsung.

This fund has also posted solid growth, returning 7.5% on average over the last five years.

Next steps

Everyone’s circumstances are different. The best investments in Ireland for you right now might well be different from the funds we’ve highlighted above.

These ideas will give you a starting point. Now you can use our online platform to design an investment plan that’s right for you.

You must be logged in to post a comment.