Investors in risk assets will be pretty satisfied with the first half of 2024. Most funds delivered sustained positive results. Investors were rewarded in almost all asset classes, with equities up over 15% in Euro terms, bonds delivering continued yield, and gold and silver both reaching their highest prices in over a decade.

Read Moneycube’s midyear market review 2024 to get our take on the year so far, the outlook from here, and understand where we see risk and opportunity in the months to come.

Broad-based growth in the first half of 2024

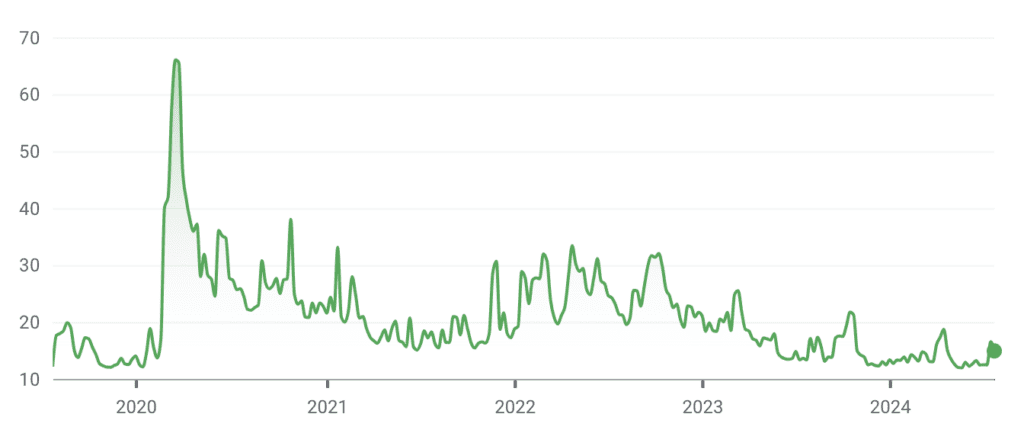

The first half of the year has seen significant growth in multiple asset categories, as the chart shows.

Sources: fund providers, MSCI, FTSE Russell

Can it last? Much of the outperformance is a rebound of confidence following long months in 2022 and 2023 which disappointed investors. To that extent, the revaluation of asset prices is justified.

And there are further reasons to be positive:

Policymakers look to be taming inflation without a significant recession in the global economy.

Corporate earnings are growing for many bellwether companies, based on limited reports so far, such as that from Alphabet, which reported a 14% rise in Q2 sales, and Coca Cola, which reported a 10% rise, on Tuesday.

There are signs that small cap company valuations are being re-assessed, boosting prospects for balanced portfolios.

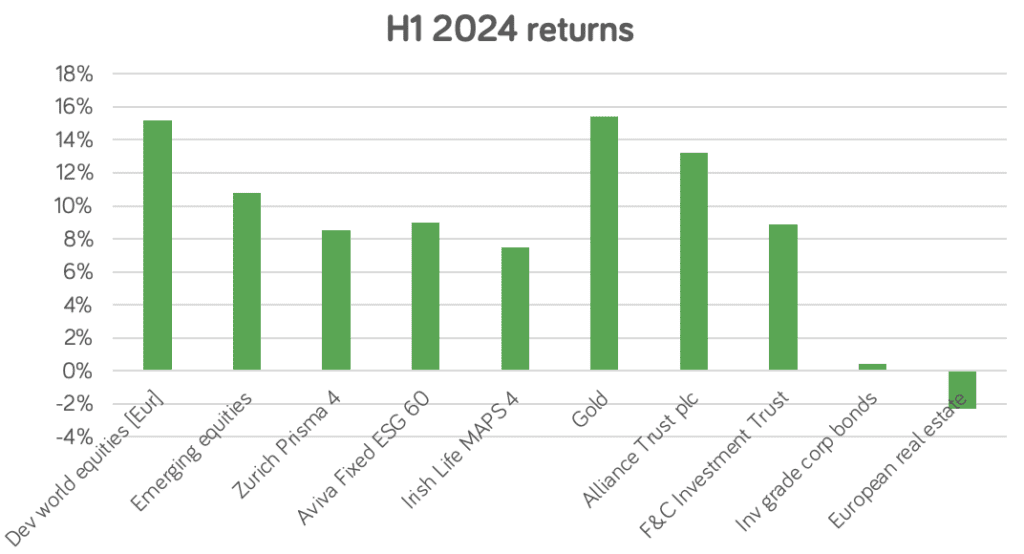

Lastly, market volatility, as measured by the VIX index, has been at materially lower levels in the first half of 2024 than for much of this decade as the chart shows.

Source: Google Finance

Of course there are risks – aren’t there always? Yet some of those risks also represent investment opportunities. For example, climate risk is presenting huge investment opportunities to build climate resilience and reconfigure infrastructure for changing needs. A company like Dublin-based CRH plc – up 20% year-to-date – stands poised to benefit.

We have identified three key areas of risk and opportunity in the second half of the year.

Interest rates and risk in a rate-falling environment

For many months now, it’s been possible to gain a risk-free return north of 3%, even as inflation abates. That will get harder in the second half of 2024, as interest rate cuts continue or even accelerate.

It’s going to be imperative for investors in search of meaningful growth to tolerate a measure of investment risk.

European investors have some additional considerations. Rate cuts in the US (as well as possible political moves to limit its strength) will likely weaken the US dollar.

As the dollar weakens, other investment markets will look more attractive, and it could be time to bank some of the stellar gains US stocks have delivered over recent years.

Politics in Europe and the US

We made clear in our investment outlook at the start of the year that politics would have a key role in market performance. That’s been true so far, with good and bad results.

French markets suffered in the light of Emmanuel Macron’s decision to call a snap election in June, with a notable spread emerging between the cost of German and French government debt. On the other side of the English channel, markets took confidence from the establishment of a more stable British government with a strong majority.

Attention turns to the US in the second half of the year, where presidential politics will be impossible to avoid.

In general, the ‘Trump trade’ posits that a Trump victory would lead to lower taxes and regulation, bigger corporate profits, and benefit certain sectors such as oil and gas.

On the other hand, Biden’s withdrawal from the election raises the prospect that Democrats will have greater influence in Congress, or potentially the presidency itself, creating a more stable investor environment.

It would be foolish to predict how events will unfold, but US politics is surely an area that could drive volatility in markets in the second half of the year.

AI stocks and the great rotation

Artificial intelligence (AI) stocks were on a tear in the first half of 2024. The sector’s darling, Nvidia, rose 150% and became for a time the world’s largest company, worth over $3 trillion. US tech companies which are spending big on AI also drove growth in the first six months.

But the first weeks of July have seen a catchup in the wider stock market. The US Russell 2000, made up of small-cap companies, had its biggest 5-day streak – up 11.5% – since April 2020. Over the same period, the tech-heavy Nasdaq 100 fell by more than 4%.

There’s no doubt huge amounts of money are being deployed in artificial intelligence. But the question of how those investments will deliver long-term returns is much harder to answer.

Regardless, the view of Moneycube’s midyear market review 2024 is that the rotation into other areas of the stock market is a healthy development, offering prospects for further broad-based growth in the second half of 2024.