In many ways, Ireland is richer than it’s ever been. For the first time, many families have significant inter-generational wealth. That’s surely a good thing – but it also creates new questions and a need for families to plan and have open conversations about money.

Money conversations can be awkward at the best of times. No-one wants to appear greedy, and it’s hard to know where to begin. This is a starting point.

Note: this is the first article in a two-part series on inter-generational wealth. For how to talk about money with your adult children, click here.

Why money conversations with your parents in retirement are needed

Wealth among older people in Ireland has been rising. As a result, the coming decades will see an inter-generational transfer of wealth. By 2020, more than one third of households had received an inheritance, and the frequency of inheritances appears to be increasing.

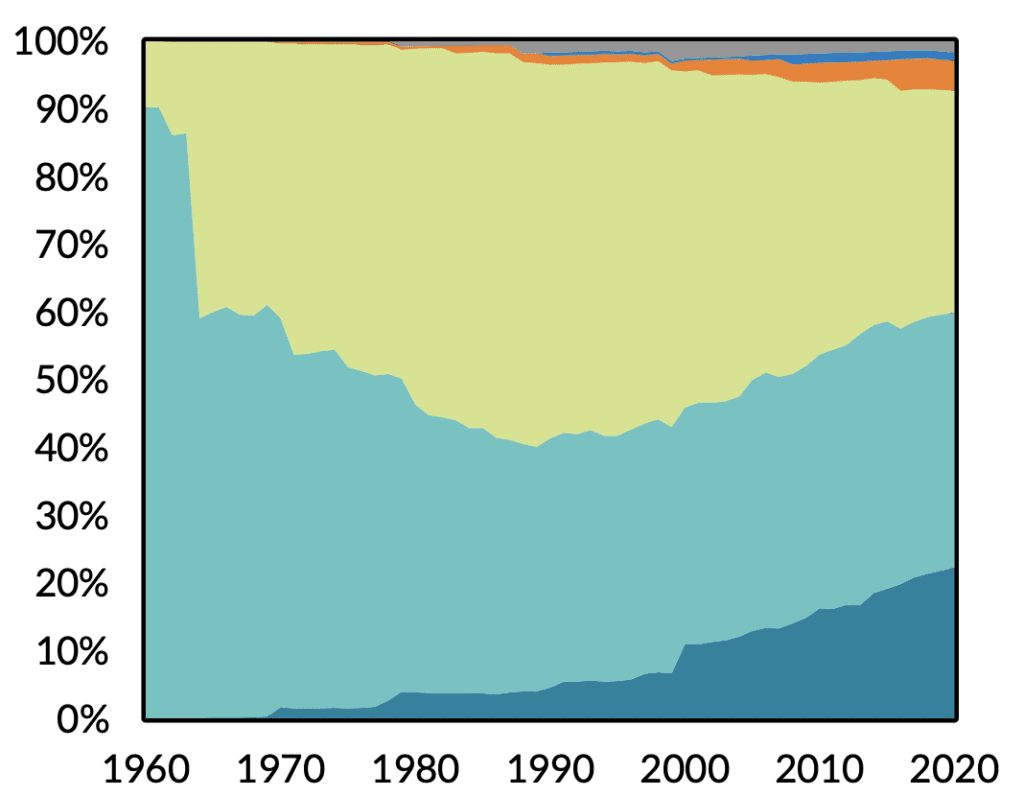

What’s more, where housing and land once comprised the vast majority of inherited wealth, shares and other investments now comprise more than 20% of the value as the chart shows.

Source: Central Bank (pdf)

The challenge for families is for this transfer to be useful and planned. Family finances need to remain dependable and well-managed as people age, while younger generations have a need to minimise inheritance taxes and (if it’s available) potentially receive money when it is needed most.

Here are five key questions to discuss.

1. How sustainable is your parents’ income?

Although Ireland’s prosperity seems greater than ever, at an individual level there can be all sorts of challenges.

Your parents are likely among the first generation in Ireland who are dependent on the investment markets for their income, in the form of approved retirement funds. Until recently, most people retired with a ‘defined benefit’ income for life, or an annuity, which had much the same effect.

While the State pension provides an element of financial security, other pillars of income in retirement (such as savings and ARFs) can run out.

The hard part of running low on money in retirement is that it’s usually not feasible to re-enter the workforce late in life.

Do your parents need to plan their income more carefully?

There are two sides to planning sustainable finances here.

The income side involves optimising savings and retirement funds. Are ARFs performing? Are they invested appropriately, and reasonably priced? Are there any debts which should be paid off?

Then there’s the expenditure side. Does it stack up?

Many of us plan to enjoy the early years of retirement actively, travelling extensively for example. They expect that later retirement will be less active, and require less income.

That can work well but it’s worth considering the financial effects, for example, of ill health or a need for long-term social care.

2. Where are your parents’ assets, and who will manage them as they get older?

Next, it’s time to consider where your parents’ wealth lies. Until recently, the wealth of most people in Ireland was tied up in two kinds of asset: property and cash in the bank.

These days, we are increasingly likely to hold a much wider variety of assets. That could include funds and shares in online accounts, overseas bank accounts and property, life assurance, paper share certificates and other assets. There can be considerable expense in monetising this wealth in an inheritance context, including the possible need to take out probate and incur legal costs in multiple countries.

As a simple step, it’s worth listing the assets – our Moneydocs financial management tool could help. Taking things further, it may be worth dematerialising paper share certificates and holding them in a single investment account.

Then there’s the question of managing the assets. It’s often the case that one partner in a relationship handles the finances. How sustainable is that as your parents get older? Should someone else – such as a son or daughter – be familiar with the details?

3. Have your Mum and Dad written wills?

A will directs how your assets should be distributed after death. Almost everyone should have one. It makes sure things are done as you’d wish, it is kinder and faster to those who come after you to deal with things, and it reduces the scope for disputes. For most people, using a solicitor to draw up the document makes sense. If your parents have no will, encourage them to take legal advice.

That may also include creating an enduring power of attorney and an advance healthcare directive, legal documents which can empower a friend or relative to take decisions on behalf of another person if they become unable to do so. A new State agency, the Decision Support Service, has been set up to facilitate this, although its launch has been controversial, with just 10 enduring powers of attorney reportedly set up in its first year of operation.

4. Who else should join the conversation?

Money has a long and sorry history of creating conflict in families. So as you begin a money conversation with your parents, consider who else should be involved (and perhaps who should not). The list of who should join the conversation likely includes your siblings, and could also involve a family solicitor, accountant or tax advisor.

5. When is the right time to pass on assets?

Capital Acquisitions Tax – aka inheritance tax – is costly for many families in Ireland. The current rate of tax is 33%. If assets are illiquid – for example property – you may need to consider where the cash will come from to settle the bill.

Many people can do some simple tax planning to reduce an eventual Capital Acquisitions Tax liability. Our second article in this series, How to talk about money with your adult children sets out three approaches to consider.