It’s been a rough few weeks for investors focused on growth stocks, especially early-stage technology companies. But what does that mean for your investments as a whole, and what are the prospects for the year ahead?

Here are three lessons from the change in sentiment.

1. Investing in fast growth is slow work

Firstly, let’s recall that investors in growth stocks have had a great run – over the last couple of years, and even over the last decade.

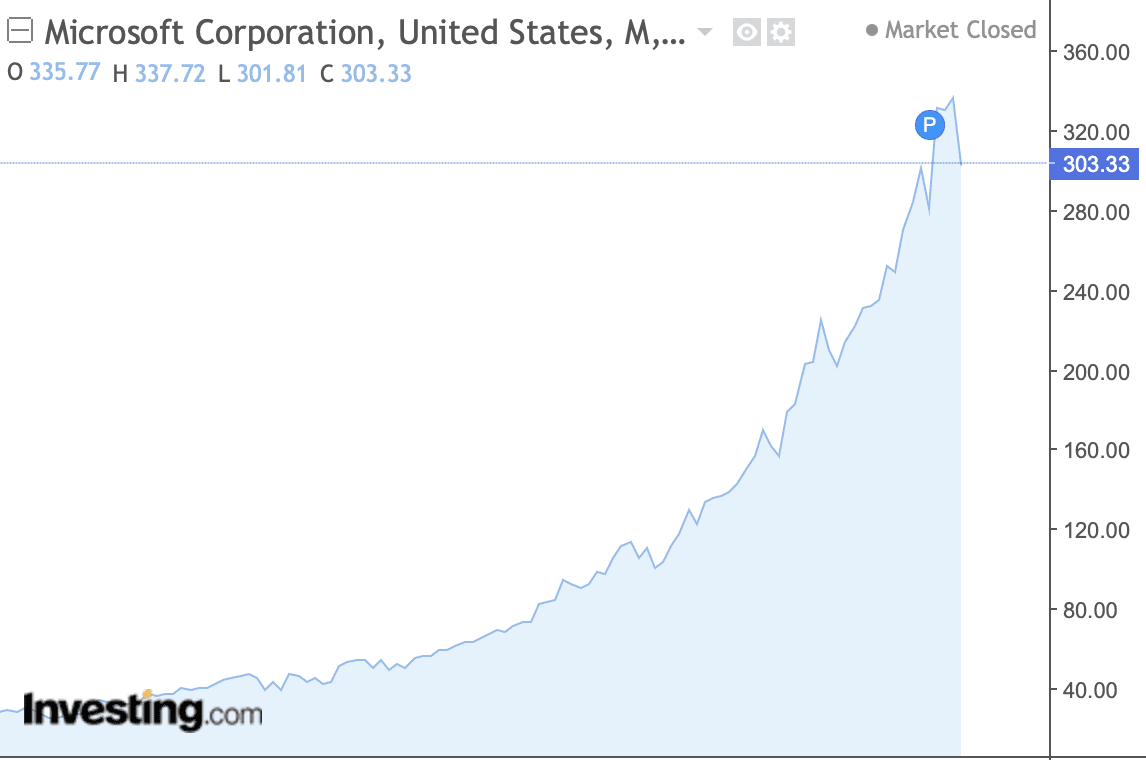

Here’s a chart of the steady rise in Microsoft stock over the last ten years, for example.

It shows a company that has repeatedly been able to deliver growth through a move to the cloud, bold acquisitions, and being used by almost every business we know.

But there have been setbacks in the share price along the way – including in 2019, 2020, 2021, and now 2022. There’s been a recovery every time in the past. Financial markets just don’t grow at a constant rate; they ebb and flow.

So at one level, growth stocks pausing for breath is part and parcel of investing your money.

The same is true for investment funds. One of our favourites, Scottish Mortgage, has had a poor 12 months – it’s down about 10% on a year ago.

But it’s up by more than 200% over five years, and more than 1,000% over ten years. Disappointing if you were looking for a rapid result, but hard to argue with if you have a sensible investment timescale.

And short-term performance certainly hasn’t dented the fund manager’s confidence that there are plenty of opportunities to go for – they just raised an extra Eur 350 million to invest in new opportunities this morning.

2. Not all growth companies are equal

Having said that, it’s clear there will be winners and losers from the current market moves. There’s one big reason why.

A primary reason for the pullback is rising interest rates.

Companies which are making little profit now, and big promises for the future, are less attractive in a world of rising interest rates. Rising rates mean that the value today of those future (promised) cashflows is lower.

That is making the going harder for early-stage technology companies, for example.

But it has much less impact on mature businesses like Apple and Alphabet which dominate the top of stock market indices and produce strong cashflows today.

3. Growth funds should be part of your wider portfolio

Of course, technology and growth-oriented investments are not the only show in town – and your equity portfolio should reflect that. What has been going on is largely a reallocation among equities rather than out of equities into other asset classes.

In particular value stocks – those perceived as being available cheaply in comparison to their earnings – are experiencing renewed investor interest.

To take one example, shares in drug company GlaxoSmithKline/ GSK are up more than 4% so far this year, and 18% over the last six months.

Gold, in contrast, is flat for the year to date. So the recent market moves does not look like a flight to safety. Instead this is mainly a rotation out of growth stocks towards value holdings.

What’s more, investing using via funds, rather than individual shares, will help cushion the impact of specific stock exposures. Investment funds spread your money among many individual positions, spreading your risk and giving your money multiple opportunities to grow.

If you own a balanced portfolio of funds, without excessive dependence on growth stocks, you’ll have protected your position as a result.

Time to review your investment portfolio? We’d love to help – just get in touch.

You must be logged in to post a comment.