After a bumpy first quarter, the markets staged a good recovery from April to June.

If you stayed invested, or kept on investing, you’ll have benefitted from a strong uptick over the last three months.

There are two big themes to the performance of investments in the second quarter of 2018.

Economic activity remains strong

Growth was pretty steady in the big economies. The US continued to add jobs. The Eurozone started April on the back of GDP growth of 0.4% in the first three months.

The European Central Bank announced that it expected that interest rates would stay stable until the summer of 2019.

These good news stories helped equities to recover from the wobble experienced earlier in the year.

Politics is adding uncertainty

At the same time, global politics had several ups and downs in the second quarter of 2018.

The US began a rapprochement with North Korea, and walked away from its nuclear agreement with Iran.

The quarter ended with escalating threats of a tariffs and even a trade war with China. In Europe, Italy’s populist government was a cause of nervousness.

The UK’s Brexit breakthrough in early July was too late to be reflected in market prices.

In particular these political news stories made for volatility in the price of government bonds in the big economies.

What does that mean for me?

In general, investors have enjoyed good growth in the markets over the last three months. While ninety days is too short a period to measure any investment, this is certainly welcome news.

If you’re invested in well-diversified multi-asset funds, you’ll already benefit from spreading your risk with any single asset class or industry.

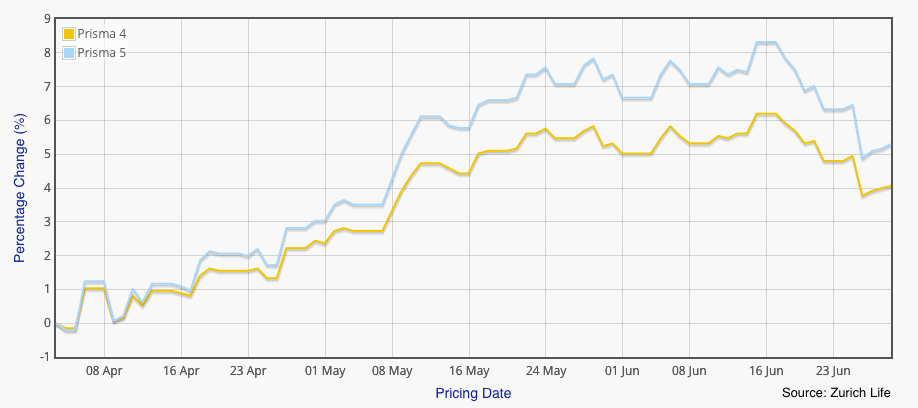

Our chart above shows the performance of Zurich Life’s Prisma 4 and Prisma 5 funds, two of the most popular choices for our customers.

Prisma 4 posted a gain of around 4% before fees, while Prisma 5 made a gain of more than 5%.