At Moneycube we believe more people should think about investing their savings.

One big reason for that is that it is almost impossible now to make any money by leaving it on deposit in the bank. Deposit rates continue at near-zero levels.

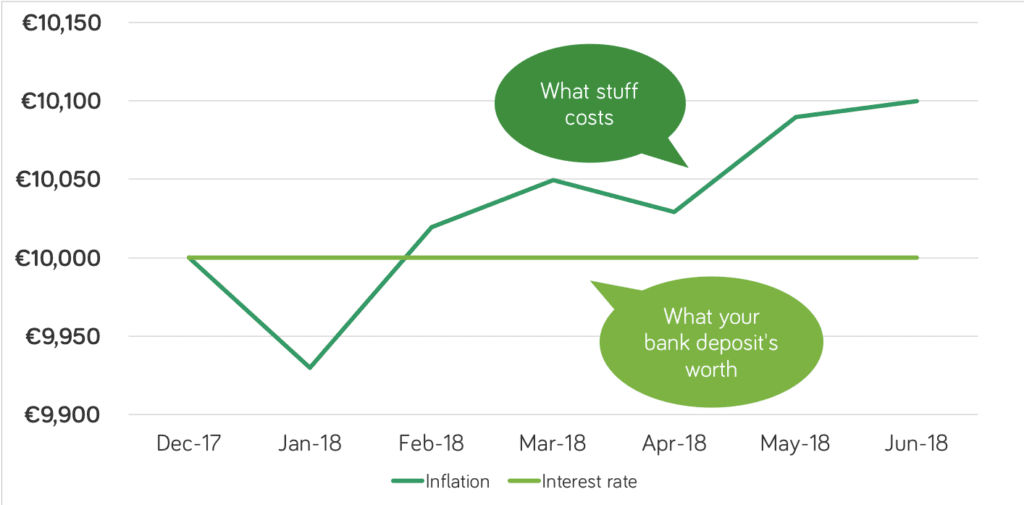

But inflation has continued to erode the value of our money, as data from the Central Statistics Office shows.

If you have a lump sum on deposit, it will buy you a smidgen less that it would have done a month ago.

In fact, four out of the first six months have seen a rise in the consumer price index. Over the 12 months to the end of June, inflation has gone up by 0.4%.

What happened?

For some time, rising housing costs have driven a rise in inflation. The July data is no different, with rental costs up 6.1% over 12 months, for example.

Other chunky rises include the taxman’s favourites, alcohol and tobacco (up 2.8% in a year), and restaurants and hotels (up 2.1%).

What are the options?

Well, you could spend your days chasing the best available rates for bank deposit accounts. But the rates are miserable, and have been for ages.

Based on Bonkers.ie data, the best 30-day notice deposit account for someone with €20,000, pays just 0.3%.

After you’ve paid DIRT to the government on that, you’ll be sitting on a princely €37.80 of interest after a year!

The investing alternative

Many people now recognise that bank savings accounts are not the way to grow your money over time. On the other hand, investment funds aim to make an above-inflation return over the medium term, so offer a better possibility to maintain and grow your wealth, after taking account of inflation.

You’ll need to give your money some time to grow, and to recover from any short-term fluctuations in value.

But investing these days is easier, faster, and better value than ever before, as businesses like Moneycube introduce technology to help you.

You can access your money at any point, and choose the right risk and reward level to suit your needs.

With inflation eating up your lump sum bank deposit, now is a great time to consider putting your money to work in an investment fund with Moneycube.