2023 is ending with momentum. Markets have enjoyed a sustained rally over the last eight weeks, spurred by growing hopes that a ‘soft landing’ can be achieved for the economy while inflation is tamed and interest rates fall.

But that disguises a year that was far from plain sailing for investors. Even at the halfway mark we could see that 2023 would have its fair share of drama.

So what should investors look out for in the markets in 2024? Here are five trends to consider.

Inflation, cash and interest rates: down, down, down

As the year draws to a close, there is renewed optimism that inflation is being brought back into line, at, say, 2-3%. In the US, interest rate cuts could come relatively early in the new year. Most analysts believe it will be mid-2024 or later before European interest rates fall.

Of course there are plenty of factors that could alter this calculation.

Closure of the Suez canal could seriously disrupt world trade and push up prices. A wider conflagration in the Middle East could ramp up oil prices, with many knock-on effects.

On the other hand, recession in Europe could lead to rates being cut more quickly than anticipated.

In general, it seems sensible to plan for falling rates, but retain some flexibility if short-term changes delay or change that expectation.

In particular, investors enjoying a return on cash deposits or the money market need a plan to invest in risk assets in a downward interest rate cycle.

What will happen as interest rates fall? Once again cash will offer low or no returns, as it did for most of the last ten years. But if policymakers can engineer a soft landing, with falling inflation and a limited recession, the prospects for equities and bonds are promising.

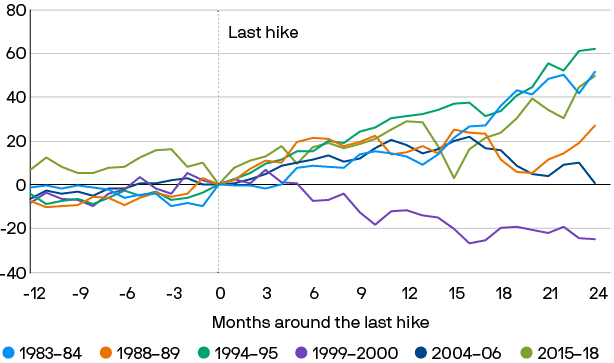

JPMorgan has analysed the behaviour of markets following the last six rate-rising cycles. In four of those six cycles, equities were up more than 25% in the following two years.

In all six cases, the 10-year US Treasury bond was up more than 15% in the two years following the last rate rise.

Source: JPMorgan Asset Management

It’s also likely bond-like instruments such as infrastructure and assets with regular cashflow will benefit from a similar tailwind in a downward interest rate cycle.

Equities: can artificial intelligence propel tech higher?

The recovery in equities is disproportionately in the ‘Magnificent Seven’ US tech firms – that’s Alphabet/ Google, Amazon, Apple, Meta/ Facebook, Microsoft, Nvidia and Tesla. These seven business now comprise around 30% of the main US index, the S&P500, and have been impossible to ignore in 2023.

For sure, the key drivers of growth in the Magnificent Seven are attractive. They have delivered recovering earnings, helped by cost-cutting measures undertaken in 2022, and enjoyed a significant recovery from oversold markets in 2022.

Above all, they offer the prospect of a wave of growth arising from generative artificial intelligence.

But can they go higher? It’s certainly the case that going into 2023, some big tech valuations are very high. For example Nvidia is valued on a price/ earnings multiple of around 66 compared to the low twenties for the S&P 500 as a whole. What’s more, the dollar is an expensive currency for Euro-based investors to invest in just now.

As we enter 2024, expectations for big tech look quite high.

Equity markets in 2024: look for quality

That’s one reason prospects for value-driven stocks look promising. Value stocks (rather than growth stocks) are those whose valuations look relatively low by comparison to fundamentals such as their earnings and dividends.

While much attention is on technology growth opportunities, such funds often focus on less prominent sectors, including energy, financial services, healthcare and telecoms.

Our value stock fund choice for 2023, Aviva’s high yield equity fund, is up over 20% year-to-date, and we expect it will continue to benefit from positive trends.

The iron rule of bonds will assert itself

Bonds have repriced significantly and the drivers in 2024 are very different from a year ago.

Bonds have an iron rule: when when yields rise, bond prices fall. In 2024, the bond investor’s hope is that this will unwind: falling interest rates will cause bond prices to recover.

Meantime current owners of bonds are enjoying higher yields and will continue offer the prospect of price rises when rates eventually fall.

Politics gets in the way

Politics will be hard to ignore in 2024. Elections are expected in Ireland, the US, the UK, South Africa, Taiwan and many other economically important countries. In the case of the US in particular, the outcome will have important implications for international trade, globalisation, and economic growth.

It seems the world will be as uncertain and hectic in 2024 as it has been this year. And like 2023, it’s likely to bring its fair share of opportunities for growth and wealth production for investors who engage with it.