The markets have been a positive place for your money in the first half of 2021. There were decent gains to be had in equities, corporate bonds (mostly) and many commodities.

What drove that performance, and what does it mean for the next six months, and beyond?

Equities had three tailwinds in H1

In Euro terms, world stock markets are up almost 14% so far in 2021 – more than in all of 2020. Three tailwinds helped this performance.

Firstly, there was a vaccine bounce at the start of the year. Led by Israel, the US and the UK, it became possible to imagine some kind of normality returning to life, in the developed world at least.

Secondly, it’s become clear that governments and central banks intend to maintain substantial support to individuals and businesses as the pandemic continues.

Thirdly, and most importantly, the world economy has adjusted to many of the changes over the last 18 months. Businesses have innovated and adapted – and many have delivered strong performances, which is filtering into asset prices.

Despite the impressive growth number, H1 still provided its share of drama, from Gamestop and meme stock frenzies, to doubts around inflation, and some market hesitancy as governments adjusted plans to reopen societies around the world.

We covered some particular risks for Irish investors in this article on investments to avoid.

There will be bumps on the way

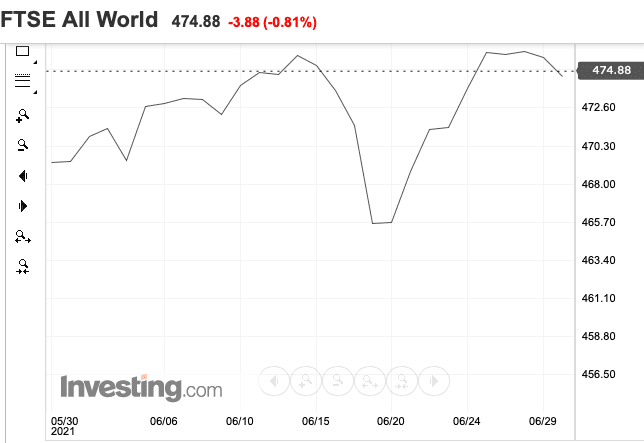

As markets have showed, there will continue to be bumps on the road. Investor nerves were tested in the middle of June, for example. The chart below shows the 2.1% fall in the FTSW All-world index from 14 to 20 June, before it went on to stage a quick recovery.

As ever, a fund-based approach and a long-term outlook were the ideal ways to minimise these risks to your portfolio, and get the benefit of strong market gains over the first half.

Other sectors are more mixed

Government bonds continued to be a mixed picture. Growing optimism about the world economy helps shares but it held back bond returns, especially in the Eurozone, where bonds were down 5% in the first six months.

Corporate bonds in contrast performed strongly, again reflecting confidence that businesses can trade well in the current conditions.

There were also winners and losers in the commodities sector. The price of Brent crude oil rose by almost half, from $51.80 at the start of the year to just over $75 by the end of the half. Copper was up more than 20%. But gold fell, as might be expected in a period of strong equity growth.

What will drive performance in the second half of 2021?

Many of the trends we identified at the start of the year remain true in July 2021.

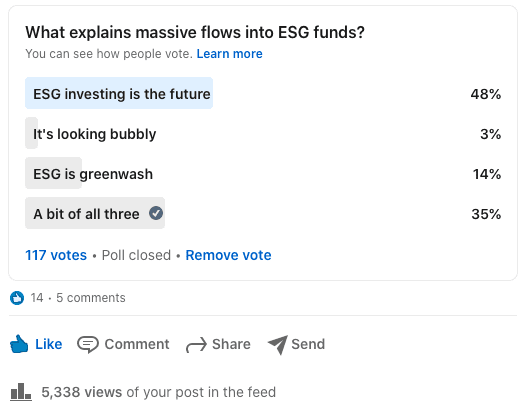

For example, the demand for investments that take account of positive ethical, social and governance criteria seems bound to continue.

Market performance, as well as the results of a recent survey we ran on LinkedIn bear this out. Almost half of respondents agreed that ESG investing is the future.

And markets will continue to fret about whether inflation will lead central banks to increase interest rates. For now, inflation is real, but likely temporary.

Remember how cheap an aircraft seat was a year ago? In fact, the percentages making headlines say more about how cheap some items became a year ago, and today’s prices are a return to normality.

You can read our most recent views on inflation and your investments in this Irish Times article from 22 June.

If there are sustained price increases, then interest rates will start to loom over the next couple of years. That will put pressure on the share prices of some technology companies. The value today of the strong future profits they promise is worth less in a high-interest rate environment.

In contrast, ‘value’ stocks, which offer strong cash flows today, will be more in favour. The performance of Guinness maker Diageo during the first half of 2021 is a good example – it’s up over 17%.

As ever, a fund-based approach will protect your capital as these changes occur, and offer a wide range of opportunities to grow your wealth.

You must be logged in to post a comment.